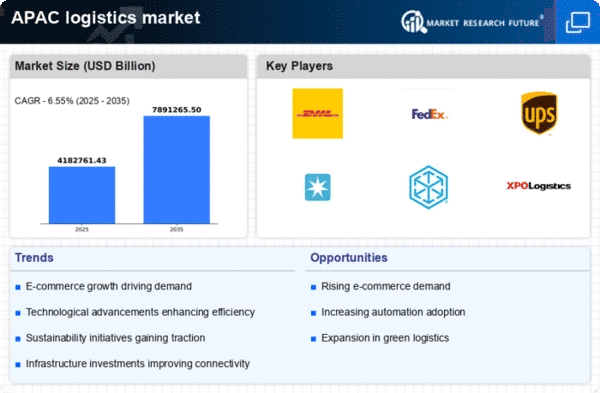

Top Industry Leaders in the Asia Pacific Logistics Market

Asia Pacific Logistics Market

In the Asia Pacific Logistics Market, rapid urbanization, expanding e-commerce activities, and infrastructural developments are driving the demand for advanced logistics solutions. The region's growing economies are witnessing increased trade activities, necessitating efficient transportation and warehousing services to meet evolving consumer demands.

Market Leaders and Strategies:

-

Global Giants: Established players like DHL, DB Schenker, Kuehne + Nagel, and Rhenus Logistics hold a significant share of the market. Their strategies focus on expanding footprints through acquisitions and mergers, while offering comprehensive logistics solutions across various modes of transport (road, air, sea). -

Regional Powerhouses: Local and regional players like SF Holding (China), CJ Logistics (South Korea), and YCH Logistics (Singapore) are strong contenders. They leverage their local expertise, established networks within the region, and cost-competitive structures to cater to specific market needs. -

E-commerce Logistics Specialists: The rise of e-commerce has spurred the growth of specialized logistics providers like JD Logistics (China), Ninja Van (Southeast Asia), and Ecom Express (India). These companies offer tailored solutions for fast-paced e-commerce fulfillment, including last-mile delivery and warehousing optimized for smaller packages.

Factors Influencing Market Share:

-

Technological Innovation: Companies that embrace automation, artificial intelligence (AI), and blockchain technology gain a competitive edge. These technologies streamline processes, optimize routes, enhance visibility, and improve efficiency, leading to cost savings and faster delivery times. -

Infrastructure Development: Investments in infrastructure like smart ports, improved road networks, and efficient customs clearance processes are crucial for smooth logistics operations. Players with strong partnerships with infrastructure providers gain a logistical advantage. -

Sustainability Initiatives: Growing environmental concerns push companies towards adopting sustainable practices. Green logistics solutions like fuel-efficient vehicles, eco-friendly packaging, and carbon offsetting programs are gaining traction, influencing customer choices and market share. -

Customer Service: Providing exceptional customer service through real-time tracking, personalized communication, and flexible delivery options is paramount in a competitive landscape.

Key Companies in the Logistics market include

- Agility Public Warehousing Co. K.S.C.P

- BCR Australia Pty Ltd.

- C H Robinson Worldwide Inc.

- CJ CheilJedang Corp.

- CMA CGM SA Group

- FedEx Corp.

- Hellmann Worldwide Logistics SE and Co KG

- Hitachi Ltd.

- Japan Post Holdings Co. Ltd.

- Nippon Express Holdings Inc.

Recent Developments

October 2023:

- DHL Express expands its Southeast Asian footprint: DHL Express invests significantly in its Vietnam operations, establishing a new gateway in Hanoi to cater to the country's burgeoning e-commerce market.

November 2023:

- SF Holding bolsters cold chain logistics: China's SF Holding announces a strategic partnership with a leading cold chain logistics provider, aiming to strengthen its offerings in the temperature-controlled transportation segment.

December 2023:

- E-commerce drives warehousing growth: Driven by e-commerce demand, India is projected to lead the creation of warehousing space within APAC in 2023, adding a significant chunk of new facilities.

As the rail rental rates have an upward variation, it was forecasted that Australia will be at the front line having rental growth in the range of 12% in the year 2023. The digital market in the region continues to bolster warehouse demand after exceeding USD 2.992 trillion in 2021.

DHL Japan and SCREEN Semiconductor Solutions Co., Ltd. have announced the signing of a long-term contract for GoGreen Plus, transportation services that have been established to reduce (insert) CO2 emissions caused by transport through the use of Biofuels commencing with SAF.