Top Industry Leaders in the Asia Pacific Energy Storage Market

*Disclaimer: List of key companies in no particular order

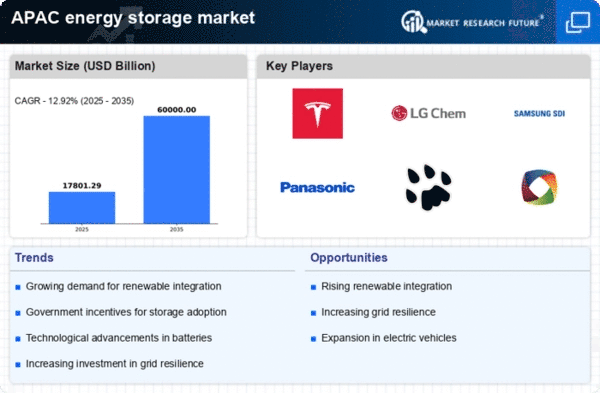

Top listed global companies in the Asia Pacific Energy Storage industry are:

Tesla

LG Chem

BYD

Panasonic

AES Energy Storage

Fluence

Siemens

ABB

Saft

ESS Inc.

NEC Energy Solutions

Samsung SDI

Sunrun

Green Charge

Enel X

Bridging the Gap by Exploring Top Leaders Competitive Landscape of the Asia Pacific Energy Storage Market

The Asia Pacific energy storage market is burgeoning, fueled by a potent cocktail of surging renewable energy adoption, ambitious climate goals, and rapid grid modernization. This dynamic landscape is home to a diverse set of players, each vying for a slice of the pie. Understanding the key strategies, trends, and factors influencing market share is crucial for navigating this competitive terrain.

Key Players, Distinct Strategies:

Global Giants: Tesla, CATL, and LG Chem lead the pack, leveraging their brand recognition, established battery manufacturing prowess, and vertical integration across the value chain. Tesla, in particular, has carved a niche with its Powerwall home energy solutions, targeting distributed applications.

Regional Champions: BYD, Sungrow, and Samsung SDI compete fiercely with global giants, leveraging their cost-competitive offerings and deep understanding of local market dynamics. BYD, for instance, leverages its expertise in electric vehicles to gain an edge in battery technology and system integration.

Established Utilities and Engineering Firms: Siemens, GE, and Mitsubishi Heavy Industries bring their engineering expertise and familiarity with grid operations to the table. They often partner with battery manufacturers or technology providers to offer comprehensive energy storage solutions to utilities and grid operators.

Emerging Startups: A wave of innovative startups like Fluence, Stem, and Redivi are disrupting the market with their focus on software-driven energy management systems, microgrid solutions, and second-life battery applications. Their agility and focus on niche markets allow them to carve out unique positions.

Market Share Analysis: Deciphering the Puzzle:

Analyzing market share in this dynamic and diverse landscape necessitates careful consideration of several factors:

Technology Focus: Different technologies, like lithium-ion batteries, pumped hydro, and flow batteries, cater to diverse applications and price points. Each player's focus on specific technologies impacts their market share in different segments.

Application Focus: The market encompasses multiple applications, from grid-scale energy storage to microgrids and residential energy management. A player's dominance in one segment may not translate to another.

Geographic Presence: The market's vastness introduces regional variations in growth and competition. China, with its aggressive renewable energy targets and supportive policies, currently holds a significant share, but other countries like India and Australia are catching up.

Partnerships and Acquisitions: Strategic partnerships and acquisitions can rapidly shift market dynamics. Collaboration between technology providers and system integrators allows players to expand their offerings and reach new customer segments.

Emerging Trends: Shaping the Future:

Several trends are shaping the competitive landscape:

Focus on Cost Reduction and Efficiency: Players are continuously innovating to develop cheaper and more efficient battery technologies, reducing the upfront cost barrier for energy storage adoption.

Integration with Renewables: As renewable energy penetration increases, seamless integration with energy storage systems will be crucial for grid stability and maximizing value. This is driving collaborative partnerships between renewable energy developers and storage providers.

Distributed Energy Storage Solutions: Increasing demand for off-grid and mini-grid solutions is driving the development of smaller, modular energy storage systems suitable for residential and commercial applications.

Second-Life Battery Applications: Repurposing used batteries for grid support or stationary applications offers a sustainable and cost-effective way to expand storage capacity. This trend is creating new opportunities for recycling and remanufacturing companies.

Overall Competitive Scenario: A Dynamic Tapestry:

Collaboration across the value chain, embracing disruptive technologies, and offering customer-centric solutions will be key differentiators in this dynamic space. While global giants currently hold sway, regional players and innovative startups are making significant strides, promising an exciting and unpredictable future for the Asia Pacific energy storage market.

Latest Company Updates:

Tesla:

- Jan 24, 2024: Tesla announces expanded Megapack production capacity in Fremont, California to meet growing demand in Asia Pacific and globally. (Source: Tesla press release)

LG Chem:

- Jan 10, 2024: LG Chem unveils new residential battery solution, RESU Prime, offering higher capacity and longer lifespan for homes in Australia and New Zealand. (Source: LG Chem press release)

BYD:

- Jan 5, 2024: BYD launches Blade LFP battery technology for commercial and industrial energy storage applications, offering enhanced safety and longevity. (Source: BYD press release)

Panasonic:

- Jan 12, 2024: Panasonic unveils Grid-Scale All-in-One (GSAIO) solution, a pre-integrated energy storage system designed for rapid deployment in Japan and other APAC markets. (Source: Panasonic press release)