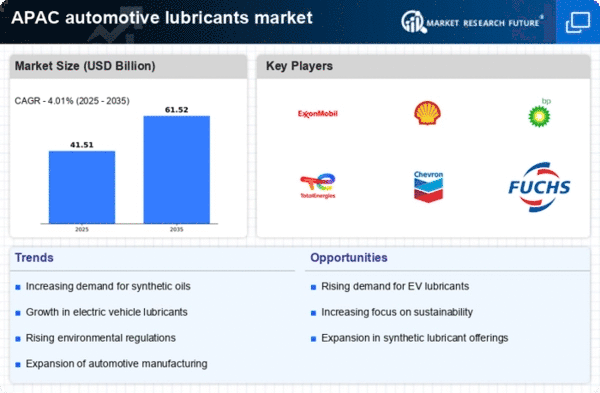

Top Industry Leaders in the Asia Pacific Automotive Lubricants Market

The Asia Pacific automotive lubricants market is a dynamic and evolving landscape, characterized by fierce competition, innovative strategies, and constant change. Understanding these factors and staying updated with the latest developments is crucial for players to navigate this complex market and secure a sustainable competitive edge.

Strategies Shaping the Battlefield:

-

Product Innovation: Leading companies like ExxonMobil and Shell are investing heavily in research and development, creating high-performance lubricants for electric and hybrid vehicles, catering to the region's growing EV adoption. ENEOS, a Japanese player, is focusing on bio-based lubricants, aligning with the sustainability push. -

Strategic Partnerships: Collaborations with car manufacturers and distributors like Maruti Suzuki and Toyota provide lubricants with OEM approvals, enhancing brand trust and market reach. BP Castrol, for example, partnered with Hyundai Motor India for factory-fill and service lubricants, solidifying their presence in the Indian market. -

Market Expansion: Targeting emerging economies like Vietnam and Indonesia with affordable product lines is a key strategy for players like Petronas and GS Caltex. This caters to the growing middle class and their increasing vehicle ownership. -

Digitalization: Embracing e-commerce platforms and online marketing empowers players to reach a wider audience, particularly in remote regions. JX Nippon Oil & Energy Corporation, through its Eneos brand, is actively utilizing digital channels for customer engagement.

Factors Determining Market Share:

-

Vehicle Type: Passenger vehicles, currently holding the largest share, are expected to witness the highest CAGR due to rising car sales in India and ASEAN countries. However, the commercial vehicle segment, driven by logistics growth, also presents significant opportunities. -

Product Type: Synthetic and semi-synthetic lubricants are gaining traction due to their superior performance and longer drain intervals, favored by consumers seeking value and convenience. Mineral lubricants still hold a significant share, particularly in price-sensitive markets. -

Country Dynamics: China, the largest market, is driven by its vast vehicle population and government policies promoting domestic players. India, with its rapid economic growth and increasing vehicle ownership, is another key battleground. Japan and South Korea, mature markets with high quality standards, offer unique challenges and opportunities.

Key Companies in the Automotive Lubricants market include

- BP PLC (Castrol)

- CHEVRON CORPORATION

- China National Petroleum Corporation

- China Petroleum & Chemical Corporation

- ENEOS Corporation

- ExxonMobil Corporation

- GS Caltex

- Idemitsu Kosan Co. Ltd

- Indian Oil Corporation Limited

- D. Motul

- PT Pertamina

- Royal Dutch Shell Plc

- TotalEnergies

Recent Developments

July 2023: ExxonMobil and Shell announce plans to invest in new lubricant manufacturing facilities in India and Indonesia, respectively, to cater to the growing demand in these markets.

August 2023: ENEOS launches a new line of synthetic lubricants formulated specifically for hybrid and electric vehicles.

September 2023: BP (Castrol) partners with a leading Chinese e-commerce platform to expand its online distribution channels in China.

October 2023: TotalEnergies and CNPC announce a joint venture to develop and market lubricants for heavy-duty vehicles in China.