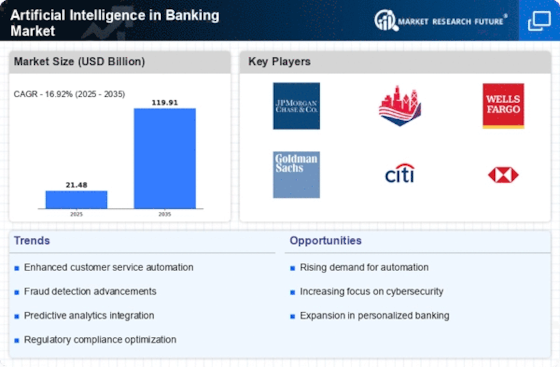

Data-Driven Decision Making

The ability to harness data effectively is transforming the banking landscape. Artificial Intelligence in Banking Market facilitates data-driven decision making by providing insights that were previously unattainable. Banks are increasingly utilizing AI algorithms to analyze customer behavior, market trends, and operational efficiencies. Reports suggest that institutions employing AI-driven analytics have improved their decision-making speed by 40%, allowing them to respond swiftly to market changes. This capability not only enhances competitiveness but also fosters innovation within the sector, suggesting a robust future for AI technologies in banking.

Enhanced Cybersecurity Measures

As cyber threats continue to evolve, the banking sector faces increasing pressure to bolster its cybersecurity defenses. Artificial Intelligence in Banking Market offers advanced solutions for detecting and mitigating cyber threats in real-time. AI systems can analyze patterns and anomalies in transaction data, identifying potential fraud before it occurs. Data indicates that banks employing AI-driven cybersecurity measures have reduced fraud losses by approximately 25%. This capability not only protects financial institutions but also instills greater confidence among customers, suggesting that the integration of AI in cybersecurity will be a key driver for growth in the Artificial Intelligence in Banking Market.

Operational Automation and Efficiency

The push for operational efficiency is a driving force behind the adoption of Artificial Intelligence in Banking Market. Automation of routine tasks through AI technologies allows banks to streamline operations, reduce human error, and lower operational costs. For instance, AI chatbots are increasingly used for customer service, handling inquiries and transactions without human intervention. Reports indicate that banks implementing AI-driven automation have achieved cost savings of up to 40%. This trend highlights the potential for AI to transform operational frameworks within the banking sector, suggesting a sustained demand for AI solutions in the Artificial Intelligence in Banking Market.

Personalization of Financial Services

The demand for personalized banking experiences is on the rise, and Artificial Intelligence in Banking Market is at the forefront of this transformation. AI technologies enable banks to tailor their services to individual customer preferences and behaviors. By analyzing customer data, AI can recommend products and services that align with specific needs, enhancing customer satisfaction. Recent studies indicate that banks utilizing AI for personalization have experienced a 20% increase in customer retention rates. This trend underscores the potential for AI to redefine customer relationships in the banking sector, driving further investment in the Artificial Intelligence in Banking Market.

Regulatory Compliance and Risk Mitigation

The increasing complexity of regulatory frameworks in the banking sector necessitates the adoption of advanced technologies. Artificial Intelligence in Banking Market appears to be a crucial ally in ensuring compliance with evolving regulations. AI systems can analyze vast amounts of data to identify potential compliance issues, thereby reducing the risk of penalties. According to recent data, financial institutions that leverage AI for compliance reporting have seen a reduction in compliance costs by up to 30%. This trend indicates that as regulations become more stringent, the demand for AI solutions in the banking sector will likely rise, driving growth in the Artificial Intelligence in Banking Market.