Automation of Routine Tasks

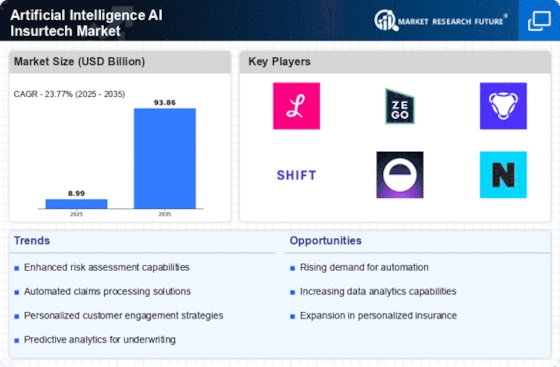

Automation is a key driver in the Artificial Intelligence AI Insurtech Market, as it streamlines various routine tasks within insurance operations. By automating processes such as policy issuance, claims processing, and customer service inquiries, insurers can significantly reduce operational costs and improve efficiency. Reports indicate that automation can lead to a 30% reduction in processing time for claims, which enhances customer satisfaction. Moreover, the shift towards automation allows human resources to focus on more complex tasks that require critical thinking and creativity. This transition not only optimizes resource allocation but also fosters innovation, making automation a pivotal element in the evolution of the Artificial Intelligence AI Insurtech Market.

Customer-Centric Innovations

The focus on customer-centric innovations is reshaping the Artificial Intelligence AI Insurtech Market. Insurers are increasingly adopting AI technologies to create personalized insurance products that cater to individual customer needs. This trend is supported by data indicating that 70% of consumers prefer tailored insurance solutions over generic offerings. By utilizing AI to analyze customer behavior and preferences, insurers can develop products that not only meet but exceed customer expectations. This shift towards personalization is likely to enhance customer loyalty and retention, positioning companies that embrace these innovations as leaders in the Artificial Intelligence AI Insurtech Market.

Enhanced Data Analytics Capabilities

The Artificial Intelligence AI Insurtech Market is experiencing a surge in enhanced data analytics capabilities. Insurers are increasingly leveraging AI to analyze vast amounts of data, which allows for more accurate risk assessments and pricing models. This trend is evidenced by the fact that companies utilizing AI-driven analytics report a 20% improvement in underwriting accuracy. Furthermore, the ability to process and analyze data in real-time enables insurers to respond swiftly to market changes, thereby enhancing their competitive edge. As the demand for data-driven decision-making grows, the integration of advanced analytics into insurance processes is likely to become a standard practice, driving further innovation within the Artificial Intelligence AI Insurtech Market.

Integration of IoT and AI Technologies

The convergence of Internet of Things (IoT) and AI technologies is emerging as a significant driver in the Artificial Intelligence AI Insurtech Market. The integration of IoT devices allows insurers to collect real-time data on policyholders, which can be analyzed using AI algorithms to assess risk more accurately. This synergy is particularly evident in sectors such as auto and health insurance, where IoT devices can provide insights into driving behavior or health metrics. It is projected that the combination of IoT and AI could reduce claims costs by up to 15%, thereby enhancing profitability for insurers. As this integration becomes more prevalent, it is likely to redefine operational models within the Artificial Intelligence AI Insurtech Market.

Regulatory Compliance and Risk Management

The increasing complexity of regulatory requirements is driving the demand for AI solutions in the Artificial Intelligence AI Insurtech Market. Insurers are utilizing AI to ensure compliance with evolving regulations, which can be both time-consuming and costly. AI technologies can assist in monitoring compliance in real-time, thereby reducing the risk of penalties and enhancing overall risk management strategies. It is estimated that companies employing AI for compliance purposes can save up to 25% in associated costs. As regulatory landscapes continue to shift, the ability to adapt quickly through AI-driven solutions will likely become a critical factor for success in the Artificial Intelligence AI Insurtech Market.