Market Share

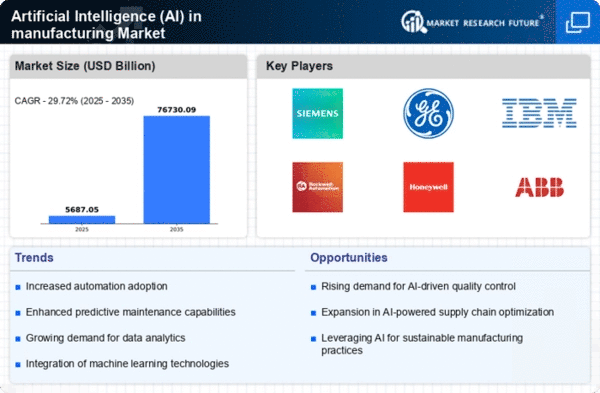

Artificial Intelligence (AI) in manufacturing Market Share Analysis

In the competitive landscape of the Artificial Intelligence (AI) in manufacturing market, market share positioning strategies are crucial for companies aiming to establish a strong presence and gain a competitive edge. One pivotal strategy involves differentiation, where companies strive to distinguish their AI solutions from competitors by offering unique features, specialized functionalities, and comprehensive integration capabilities. By emphasizing innovation, adaptability, and industry-specific expertise, companies seek to carve out a distinct niche and attract a discerning customer base, ultimately enhancing their market share.

Strategic partnerships and collaborations are integral components of market share positioning in the AI manufacturing sector. Companies often form alliances with technology partners, research institutions, or industry leaders to enhance their product offerings and capabilities. These collaborations lead to the development of integrated and interoperable AI solutions that address a broader spectrum of manufacturing needs. The collaborative approach not only expands the range of services but also positions companies as leaders in providing comprehensive, end-to-end AI solutions, thereby increasing their market share

Acquisitions and mergers are impactful strategies employed by companies to strengthen their market share in the AI manufacturing market. Through strategic acquisitions, companies can gain access to cutting-edge technologies, talent pools, or niche markets. Merging with or acquiring competitors allows companies to consolidate resources, eliminate redundancies, and strengthen their overall market position. This strategic move is particularly effective for companies seeking rapid expansion and market dominance in a highly competitive environment.

A customer-centric approach is pivotal for securing and expanding market share in the AI manufacturing sector. Companies that prioritize understanding and meeting the unique needs of their customers can build strong and lasting relationships. Offering personalized solutions, providing excellent customer support, and continuously enhancing products based on customer feedback contribute to customer satisfaction and loyalty. A satisfied customer base not only drives repeat business but also serves as a valuable asset in attracting new customers through positive testimonials and referrals, ultimately expanding market share.

Price positioning is a crucial strategy that companies employ to gain a competitive advantage in the AI manufacturing market. Some companies focus on offering cost-effective solutions to appeal to budget-conscious manufacturers, aiming to capture market share by providing value for money. Others position themselves as premium providers, emphasizing advanced features, superior performance, and dedicated support services. By strategically determining their price positioning, companies can cater to specific market segments and optimize their market share based on the perceived value of their offerings.

Continued investment in research and development is a strategic imperative for companies aiming to maintain or expand their market share in the rapidly evolving AI manufacturing market. The introduction of new AI algorithms, machine learning models, and innovative features keeps offerings competitive and aligned with the evolving needs of manufacturers. By staying at the forefront of technological advancements, companies can differentiate themselves, attract new customers, and solidify their market share.

Geographical expansion is a market share positioning strategy often employed by companies looking to tap into new markets and regions. By understanding the unique manufacturing requirements of different geographic areas, companies can tailor their AI solutions to meet specific local needs. This strategy allows companies to diversify their customer base, reduce dependency on specific markets, and position themselves as global leaders in the AI manufacturing space.

Leave a Comment