Areca Nut Size

Areca Nut Market Growth Projections and Opportunities

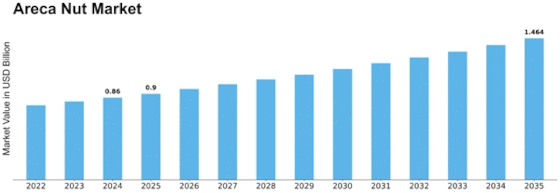

In 2022, the areca nut market was estimated to be worth USD 0.815 billion. The industry for areca nuts is expected to increase at a compound annual growth rate (CAGR) of 5.00% between 2023 and 2032, from USD 0.85575 billion in 2023 to USD 1.264 billion by 2032. The main factors propelling the market expansion are growing consumer awareness of the health advantages of areca nuts and the increasing acceptance of smokeless tobacco products.

The Areca nut market is influenced by a myriad of factors that collectively shape its dynamics. One crucial element is geographical location, as the cultivation of Areca nut predominantly occurs in specific regions with suitable climates. The market is notably concentrated in South and Southeast Asia, where countries like India, Indonesia, and Malaysia are major contributors to production. Climate variations, soil quality, and topography play pivotal roles in determining the success of Areca nut cultivation, making these factors intrinsic to market fluctuations.

Another key factor is consumer demand, which is closely tied to cultural practices and traditions. Areca nut is commonly used in social and religious rituals in various communities, contributing to steady demand. Additionally, the nut is a primary ingredient in traditional chewing preparations, such as betel quid, popular in many Asian cultures. Shifts in consumer preferences, awareness campaigns regarding health risks associated with Areca nut consumption, and changing cultural practices can significantly impact market trends.

Economic factors, including income levels and purchasing power, also influence the Areca nut market. Higher disposable incomes often lead to increased spending on non-essential items, potentially boosting the demand for Areca nut products. Conversely, economic downturns or income disparities may result in decreased consumption. Moreover, the Areca nut market is susceptible to global economic conditions, affecting export and import patterns, as well as the overall market value.

Government policies and regulations are instrumental in shaping the Areca nut market. Policies related to agricultural practices, trade regulations, and subsidies can impact production costs and market accessibility. Environmental regulations also play a role, as sustainable farming practices are increasingly emphasized. Changes in government policies, such as incentives for farmers or regulations on Areca nut products, can have far-reaching effects on the market.

Technological advancements in agriculture contribute to the efficiency and yield of Areca nut cultivation. Improved farming techniques, pest control methods, and irrigation systems enhance productivity and quality. Additionally, advancements in processing technologies influence the quality and variety of Areca nut products available in the market. Keeping pace with technological developments is crucial for farmers and businesses to remain competitive and meet evolving consumer expectations.

Market competition and supply chain dynamics are vital factors influencing the Areca nut market. The presence of numerous producers and distributors fosters competition, affecting pricing and product differentiation. Efficient supply chains, from cultivation to distribution, are essential for maintaining the freshness and quality of Areca nut products. Any disruptions in the supply chain, whether due to natural disasters or logistical challenges, can have cascading effects on market dynamics.

Leave a Comment