Applied Ai In Energy Utilities Size

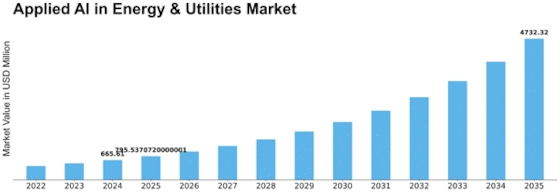

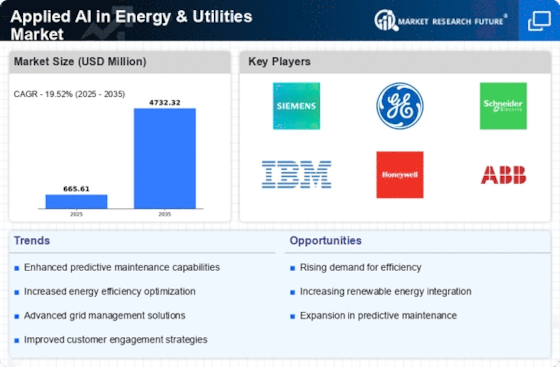

Applied AI in Energy & Utilities Market Growth Projections and Opportunities

Efficiency as well as sustainability quests and assimilation of intelligent technologies are some of the motives that make applied AI market dynamics in energy and utilities become dynamic. Energy optimization, predictive maintenance, grid management and asset monitoring are a few examples of the plethora of applications included in this domain. Over time, several key drivers have continually evolved making this market very dynamic and reflecting the sector’s ability to innovate as well as endure change brought about by shifting energy landscapes and environmental pressures. Another driver shaping the market dynamics of Applied AI in Energy & Utilities is the urgent need for enhanced operational efficiency and better asset management. By analyzing data coming from a lot of sensors, devices or even infrastructure, artificial intelligence applications can be used to predict equipment failures; optimize maintenance schedules; improve overall performance through operating procedures enhancement. The power to spot anomalies using AI helps future glitches before they happen resulting to reduced downtimes, minimized operation costs, extended life periods for vital assets. A quest for operational excellence is one factor driving up adoption rates of Artificial Intelligence across energy production and distribution companies.

However, smart grids’ development alongside renewable energy incorporation significantly affects the applied ai in energy & utilities market dynamics. In an effort to optimize how electricity is produced distributed and consumed considering growing integration of solar wind among other sources onto the power grid AI techs play central roles here being deployed.. Smart grids use AI solutions to cope with renewable energy fluctuation levels while balancing demand and supply as well as improving grid reliability. This brings about adaptive/ responsive forms of energy systems which can handle intermittent decentralized renewables.

On the other hand, sustainable operations requirements also impact significantly on applied ai in energy & utilities’ market dynamics. It results into initiatives related to saving on energy use , reducing carbon footprints , optimizing resource usage etc within various industries being geared towards causing changes that enhance both internal responsiveness but also maintain competitiveness within their business ecosystems at large . Machine learning algorithms sift historical plus real-time data to single out areas where energy can be saved, emissions cut and sustainable practices adopted. These are just some of the reasons for incorporating AI-centered solutions as part of the industry’s strategy to mitigate climate change and deliver greener energy supplies.

Leave a Comment