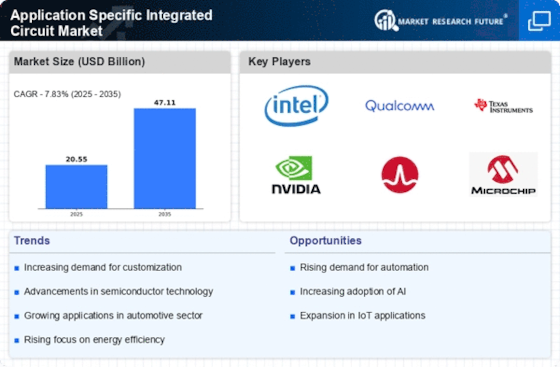

Top Industry Leaders in the Application Specific Integrated Circuit Market

Competitive Landscape of Application Specific Integrated Circuit Market

The ASIC market, where custom-designed chips breathe life into cutting-edge technology, is a thrilling maze of innovation, competition, and constant evolution. this dynamic arena demands a clear understanding of the strategies, players, and trends shaping its landscape.

Key Players:

- Intel Corporation

- Texas Instruments Inc.

- STMicroelectronics N.V

- Infineon Technologies AG

- Renesas Electronics Corporation

- Maxim Integrated Products Inc.

- Analog devises Inc.

- ON Semiconductor

- NXP Semiconductors N.V

- Qualcomm Inc.

- Linear Technology Corporation

- Brunswick Corporation

Strategies Adopted by Key Players:

- Technological Innovation: Pushing the boundaries of chip design, shrinking transistor sizes, and integrating cutting-edge features like AI acceleration and high-performance computing capabilities is key to staying ahead of the curve and attracting customers seeking the latest technology.

- Application-Specific Expertise: Developing deep understanding of specific industries like automotive, aerospace, medical devices, and communications allows players to tailor ASIC solutions to meet unique performance, power, and cost requirements. This tailored approach resonates with customers seeking optimized chips for their specific needs.

- Focus on Turnaround Time and Cost Efficiency: Offering swift design and fabrication processes, optimizing supply chains, and providing competitive pricing are crucial for winning contracts and keeping customers satisfied. In this fast-paced market, speed and cost-effectiveness are key differentiators.

- Intellectual Property Protection and Design Security: Strong IP protection safeguards valuable technology and builds trust with customers, while robust design security measures mitigate risks and safeguard intellectual property. Ensuring secure and protected designs is vital in this highly competitive environment.

- Partnerships and Collaborations: Teaming up with equipment manufacturers, design houses, software developers, and research institutions fosters innovation, expands reach, and opens doors to new markets. By forging strategic partnerships, players can leverage complementary expertise and broaden their capabilities.

Factors for Market Share Analysis:

- Revenue Share: This provides a direct measure of a company's financial footprint in the market, indicating its overall size and influence. A larger revenue share suggests a stronger market position and wider customer base.

- Unit Shipment Volume: Tracking the number of ASICs shipped offers insights into market penetration and demand for specific technologies and applications. Higher unit shipments reveal a company's ability to capture customer interest and deliver successful solutions.

- Average Selling Price (ASP): Understanding the average price per ASIC reveals a company's focus on high-end or low-cost solutions and its profitability. A high ASP may indicate specialization in complex, high-performance chips, while a lower ASP suggests a focus on cost-conscious customers.

- Geographic Market Share: Dominance in key regions like North America, Asia Pacific, and Europe helps assess global competitiveness and identify potential growth opportunities. Understanding regional strengths and weaknesses allows players to tailor their strategies to specific markets.

- Customer Satisfaction and Brand Reputation: Positive customer feedback and a strong brand image attract new customers and strengthen market position. Building trust and loyalty through superior customer service and reliable solutions is crucial for long-term success.

New and Emerging Companies:

- Rise of Field-Programmable Gate Arrays (FPGAs): These reconfigurable chips offer flexibility and adaptability, appealing to customers needing to modify functionality post-fabrication. The ability to customize chips after fabrication opens up new possibilities and caters to dynamic needs.

- Focus on Open-Source Chip Design: Initiatives like RISC-V are driving the development of open-source chip architectures, potentially reducing design costs and fostering collaboration. Open-source design democratizes access to chip technology and encourages innovation.

- Integration of AI and Machine Learning: Embedding AI hardware accelerators within ASICs is unlocking new possibilities for edge computing and real-time data processing. This trend caters to the growing demand for intelligent devices and edge computing solutions.

Latest Company Updates:

Intel Corporation:

- December 6, 2023: Announced the launch of the 4th Gen Intel Xeon Scalable processors with built-in AI acceleration features, targeting cloud computing and high-performance workloads.

- January 9, 2024: Revealed plans to invest $20 billion in new chip factories in Germany, further expanding its European production capacity.

Texas Instruments Inc:

- December 19, 2023: Unveiled the C2000 real-time control microcontrollers with integrated analog and mixed-signal capabilities, designed for industrial automation and motor control applications.

- January 3, 2024: Announced a collaboration with Siemens to develop custom ASICs for industrial automation and smart grid systems, leveraging TI's expertise in low-power and reliable chip design.