Top Industry Leaders in the Application Release Automation Market

Competitive Landscape of Application Release Automation Market:

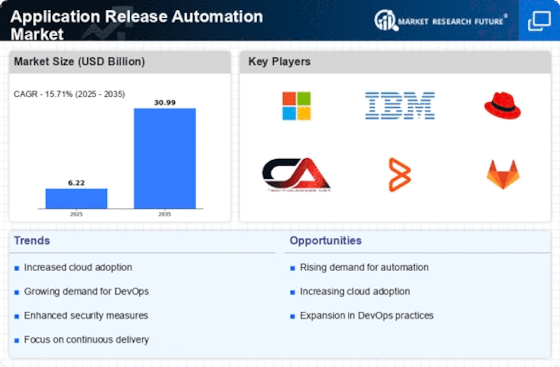

The application release automation (ARA) market is experiencing explosive growth, fueled by the ever-increasing demand for faster, more efficient software delivery. This dynamism translates to a fiercely competitive landscape, with established players vying for dominance alongside innovative startups. To navigate this dynamic environment, understanding the key players, their strategies, and the factors influencing market share is crucial.

Key Players:

- Microsoft Corporation (US)

- HP Company (US)

- CA Technologies (US)

- IBM Corporation (US)

- Micro Focus International PLC (UK)

- MidVision Ltd. (UK)

- BMC Software (US)

- Red Hat Inc. (US)

- VMware Inc. (US)

- XebiaLabs Inc. (US)

- Electric Cloud Inc.

- Serena Software Inc.

Strategies Adopted:

- Product Innovation: Continuous development of features like AI-powered analytics, automation of rollback procedures, and self-healing deployments is crucial for staying ahead. Integrating with cloud platforms and security solutions is also essential.

- Subscription Models: The shift towards subscription-based pricing models with recurring revenue streams is becoming increasingly popular, offering predictable income and fostering customer loyalty.

- Partnerships and Acquisitions: Collaborating with other vendors in the software delivery ecosystem and acquiring complementary technologies expand reach and offer comprehensive solutions.

- Focus on Specific Verticals: Tailoring solutions and expertise to cater to the unique needs of industries like healthcare, finance, or manufacturing opens up new market segments.

Factors for Market Share Analysis:

- Product Portfolio Breadth and Depth: The range of features and functionalities offered, along with their maturity and integration capabilities, determine a vendor's attractiveness.

- Target Market Focus: Understanding which industries and organization sizes a vendor caters to helps assess their potential market share.

- Customer Satisfaction and Support: Positive user experiences, efficient support channels, and strong community engagement contribute to loyalty and market share.

- Pricing and Licensing Models: Competitive pricing and flexible licensing options attract budget-conscious customers and small businesses.

- Innovation and Technology Adoption: Continuous investment in R&D and early adoption of emerging technologies like AI and machine learning can give vendors a competitive edge.

New and Emerging Companies:

Several startups are disrupting the market with innovative solutions:

- Cloud-based ARA platforms: CloudBees focuses on CI/CD pipelines and DevSecOps, while Octopus Deploy offers deployment orchestration and automation.

- AI-powered automation: Copado and XebiaLabs leverage AI to automate manual tasks and optimize release processes.

- Containerization and microservices: Codefresh and Shippable cater to the growing need for containerized and microservices-based deployments.

Current Company Investment Trends:

- Focus on AI and Machine Learning: Integrating AI for anomaly detection, predictive analytics, and automated decision-making is a top priority for many vendors.

- Security and Compliance: Building robust security features and adhering to industry compliance standards are critical for attracting enterprise customers.

- Cloud-Native Solutions: Development of cloud-native ARA platforms that leverage the scalability and elasticity of cloud infrastructure is gaining traction.

- Open-Source Integration: Open-source tools and platforms are finding their way into proprietary solutions, fostering collaboration and driving innovation.

- Customer-Centric Approach: Investing in customer success initiatives, offering personalized support, and building strong relationships are key to retaining clients in this competitive landscape.

Latest Company Updates:

January 9, 2024, Octopus Deploy releases new version with improved security features and workflow automation capabilities.

December 12, 2023, XebiaLabs partners with GitLab to integrate its DevOps platform "XL Deploy" with GitLab's CI/CD pipelines, streamlining release processes.

November 14, 2023, Sysdig launches continuous integration and delivery (CI/CD) platform, aiming to simplify and accelerate software delivery for cloud-native applications.

October 26, 2023, CloudBees acquires continuous delivery platform "Codefresh," expanding its portfolio of release automation tools.