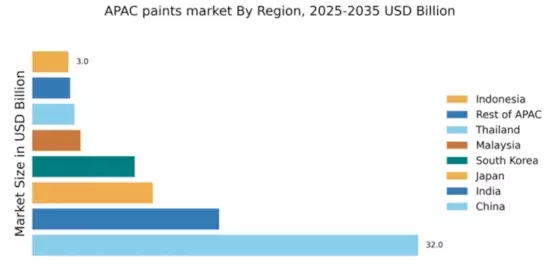

China : Unmatched Growth and Demand Trends

China holds a commanding 32.0% market share in the APAC paints and coatings sector, valued at approximately $XX billion. Key growth drivers include rapid urbanization, increased construction activities, and a rising demand for eco-friendly products. Government initiatives promoting sustainable practices and stringent regulations on VOC emissions are shaping consumption patterns. Infrastructure development, particularly in tier-1 and tier-2 cities, is further fueling demand for high-quality coatings.

India : Emerging Market with High Potential

India accounts for 15.5% of the APAC paints market, valued at around $XX billion. The growth is driven by increasing disposable incomes, urbanization, and a booming real estate sector. Government initiatives like the Housing for All scheme are enhancing demand for residential and commercial coatings. The market is witnessing a shift towards water-based and low-VOC products, aligning with environmental regulations and consumer preferences.

Japan : A Leader in Advanced Technologies

Japan holds a 10.0% share of the APAC paints market, valued at approximately $XX billion. The market is driven by technological advancements and a strong focus on quality. The automotive and electronics sectors are significant consumers of high-performance coatings. Regulatory policies promoting environmental sustainability are influencing product development, with a growing emphasis on eco-friendly solutions and compliance with strict standards.

South Korea : A Hub for High-Performance Products

South Korea represents 8.5% of the APAC paints market, valued at around $XX billion. The growth is fueled by the automotive and construction industries, which demand high-performance coatings. Government regulations on environmental standards are pushing manufacturers towards innovative, sustainable solutions. The market is characterized by a competitive landscape with local players like KCC Corporation and global giants like PPG Industries.

Malaysia : Sustainability Driving Market Trends

Malaysia captures 4.0% of the APAC paints market, valued at approximately $XX billion. The growth is driven by increasing awareness of environmental issues and a shift towards sustainable products. Government initiatives promoting green building practices are enhancing demand for eco-friendly coatings. The market is concentrated in urban areas like Kuala Lumpur and Penang, where construction activities are booming.

Thailand : A Market with Varied Demand

Thailand holds a 3.5% share of the APAC paints market, valued at around $XX billion. The growth is supported by diverse applications across construction, automotive, and industrial sectors. Government policies encouraging infrastructure development are boosting demand for coatings. The competitive landscape includes both local manufacturers and international players, with Bangkok being a key market hub.

Indonesia : Rising Demand in Construction Sector

Indonesia accounts for 3.0% of the APAC paints market, valued at approximately $XX billion. The growth is driven by a booming construction sector and increasing urbanization. Government initiatives aimed at improving infrastructure are enhancing market prospects. The competitive landscape features both local brands and international companies, with Jakarta being a significant market for paints and coatings.

Rest of APAC : Diverse Opportunities Across Regions

The Rest of APAC holds a 3.14% share of the paints market, valued at around $XX billion. This sub-region includes various emerging markets with unique growth drivers, such as urbanization and industrialization. Government policies promoting infrastructure development are creating opportunities for coatings manufacturers. The competitive landscape varies, with local players dominating in some areas and international brands in others.