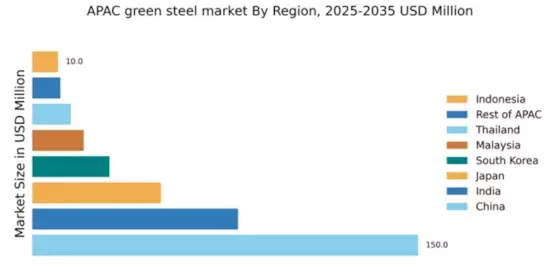

China : Unmatched Production and Demand Growth

Key markets include major cities like Beijing, Shanghai, and Shenzhen, where industrial activities are concentrated. The competitive landscape features significant players such as POSCO and Tata Steel, alongside local giants. The business environment is characterized by a strong push for innovation in green technologies, with applications spanning construction, automotive, and energy sectors. Local dynamics are influenced by stringent environmental regulations and a growing emphasis on sustainability.

India : Sustainable Growth and Innovation Focus

Key markets include states like Maharashtra and Gujarat, where industrial hubs are rapidly developing. The competitive landscape features Tata Steel and JSW Steel as major players, driving innovation in green technologies. The local business environment is becoming increasingly favorable, with supportive policies and incentives for green manufacturing. Applications in construction and infrastructure development are particularly prominent, reflecting a broader trend towards sustainability.

Japan : Technology-Driven Market Transformation

Key markets include Tokyo and Osaka, where industrial activities are concentrated. The competitive landscape features major players like Nippon Steel and JFE Steel, who are investing heavily in R&D for green technologies. The local business environment is characterized by a strong emphasis on quality and innovation, with applications in automotive and construction sectors. The push for sustainability is reshaping market dynamics, fostering collaboration between industry and government.

South Korea : Government Support and Industry Growth

Key markets include Seoul and Busan, where industrial activities are concentrated. Major players like POSCO and Hyundai Steel are leading the charge in green steel production, investing in innovative technologies. The competitive landscape is evolving, with a strong emphasis on collaboration between government and industry. Applications in construction and energy sectors are expanding, reflecting a broader commitment to sustainability.

Malaysia : Sustainable Development in Focus

Key markets include Selangor and Penang, where industrial activities are concentrated. The competitive landscape features local players like Ann Joo Resources and Southern Steel, who are increasingly adopting green technologies. The local business environment is becoming more favorable, with supportive policies and incentives for green manufacturing. Applications in construction and infrastructure development are particularly prominent, reflecting a broader trend towards sustainability.

Thailand : Emerging Trends in Green Production

Key markets include Bangkok and Rayong, where industrial activities are concentrated. The competitive landscape features major players like Sahaviriya Steel Industries and Thai Steel Cable, who are investing in green technologies. The local business environment is evolving, with increasing support for sustainable practices. Applications in construction and energy sectors are expanding, reflecting a broader commitment to sustainability.

Indonesia : Sustainability in Industrial Growth

Key markets include Jakarta and Surabaya, where industrial activities are concentrated. The competitive landscape features local players like Krakatau Steel and Gunung Steel Group, who are increasingly adopting green technologies. The local business environment is becoming more favorable, with supportive policies for green manufacturing. Applications in construction and infrastructure development are particularly prominent, reflecting a broader trend towards sustainability.

Rest of APAC : Regional Variations in Market Dynamics

Key markets include emerging economies in Southeast Asia, where industrial activities are expanding. The competitive landscape features a mix of local and international players, each adapting to regional dynamics. The local business environment is characterized by varying levels of support for green initiatives, with applications in construction and energy sectors gaining traction. This diversity reflects a broader commitment to sustainability across the region.