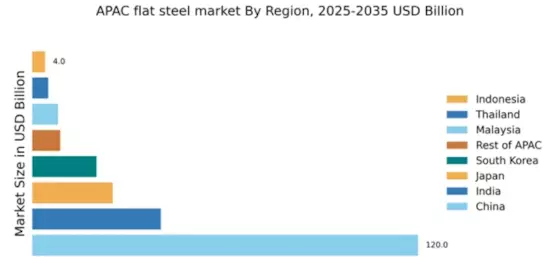

China : Unmatched Production and Demand Growth

China holds a staggering 120.0 million tons in the flat steel market, representing a significant share of the APAC region. Key growth drivers include robust industrialization, urbanization, and government initiatives aimed at infrastructure development. The demand for flat steel is primarily driven by the automotive and construction sectors, with policies promoting green steel production further enhancing market dynamics. The government’s focus on sustainable practices is reshaping consumption patterns, leading to increased investments in advanced manufacturing technologies.

India : Emerging Market with High Potential

India's flat steel market is valued at 40.0 million tons, showcasing a growing demand driven by infrastructure projects and the automotive sector. The government's initiatives, such as the National Steel Policy, aim to increase production capacity and promote local manufacturing. Consumption patterns are shifting towards higher-quality steel products, influenced by rising urbanization and industrial activities. Regulatory support for green initiatives is also gaining traction, further stimulating market growth.

Japan : Innovation in Steel Production

Japan's flat steel market, valued at 25.0 million tons, is characterized by advanced manufacturing techniques and high-quality production. Key growth drivers include the automotive and electronics sectors, which demand precision-engineered steel products. The government’s focus on innovation and sustainability is evident in policies promoting R&D in steel technologies. Consumption trends reflect a shift towards lightweight and high-strength materials, aligning with global automotive standards.

South Korea : Competitive Landscape and Innovation

South Korea's flat steel market, valued at 20.0 million tons, is heavily export-oriented, with major players like POSCO leading the charge. The market is driven by demand from the shipbuilding and automotive industries, supported by government initiatives to enhance production efficiency. Regulatory frameworks encourage innovation and sustainability, fostering a competitive environment. Consumption patterns are increasingly leaning towards high-strength steel products, essential for modern manufacturing.

Malaysia : Strategic Location for Steel Trade

Malaysia's flat steel market, valued at 8.0 million tons, is witnessing growth driven by regional demand and strategic trade agreements. The government’s initiatives to boost local manufacturing and infrastructure development are key growth factors. Consumption trends are influenced by the construction and automotive sectors, with increasing investments in green technologies. Regulatory support for sustainable practices is shaping the market landscape, enhancing competitiveness.

Thailand : Focus on Automotive and Construction

Thailand's flat steel market, valued at 5.0 million tons, is characterized by diverse applications across automotive and construction sectors. Key growth drivers include government policies promoting infrastructure development and local manufacturing. Consumption patterns are shifting towards high-quality steel products, influenced by rising industrial activities. The competitive landscape features both local and international players, with a focus on innovation and sustainability in production processes.

Indonesia : Investments in Infrastructure Development

Indonesia's flat steel market, valued at 4.0 million tons, is poised for growth driven by significant investments in infrastructure and industrial development. Government initiatives aimed at enhancing local production capacity are key growth factors. Consumption trends reflect increasing demand from the construction and automotive sectors, with a focus on sustainable practices. The competitive landscape is evolving, with both domestic and international players vying for market share.

Rest of APAC : Varied Demand Across Sub-regions

The Rest of APAC flat steel market, valued at 8.72 million tons, encompasses a diverse range of countries with unique market dynamics. Growth drivers vary significantly, influenced by local industrial activities and government policies. Consumption patterns reflect regional demands, with a focus on construction and manufacturing sectors. The competitive landscape is fragmented, featuring both local and international players, each adapting to specific market conditions and regulatory environments.