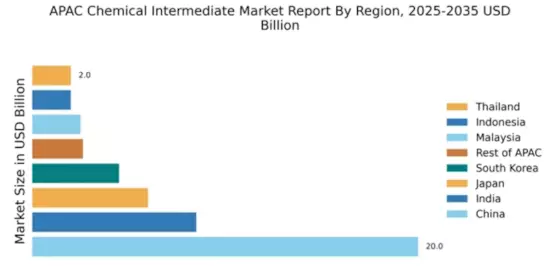

China : Unmatched Growth and Demand Trends

China holds a commanding 20.0% market share in the APAC chemical intermediate sector, valued at approximately $XX billion. Key growth drivers include rapid industrialization, increasing demand from the automotive and electronics sectors, and government initiatives promoting sustainable practices. Regulatory policies are becoming more stringent, pushing companies towards greener production methods. Infrastructure development, particularly in coastal cities like Shanghai and Shenzhen, is enhancing logistics and supply chain efficiency.

India : Rapid Growth in Chemical Demand

India accounts for 8.5% of the APAC market, valued at around $XX billion. The growth is fueled by increasing urbanization, a burgeoning middle class, and rising demand in pharmaceuticals and agriculture. Government initiatives like "Make in India" are boosting local manufacturing, while regulatory frameworks are evolving to support sustainable practices. The infrastructure development in states like Gujarat and Maharashtra is also enhancing production capabilities.

Japan : Technological Advancements Drive Growth

Japan holds a 6.0% market share in the chemical intermediate sector, valued at approximately $XX billion. The market is driven by technological advancements and a strong focus on R&D in sectors like electronics and automotive. Regulatory policies are stringent, ensuring high safety and environmental standards. The country's advanced infrastructure supports efficient production and distribution, particularly in regions like Tokyo and Osaka.

South Korea : Strong Industrial Base and Innovation

South Korea represents 4.5% of the APAC market, valued at around $XX billion. The growth is driven by a strong industrial base, particularly in electronics and automotive sectors. Government policies are supportive of innovation and sustainability, with initiatives aimed at reducing carbon emissions. Key cities like Seoul and Busan are central to the chemical industry, hosting major players like LG Chem and SK Innovation.

Malaysia : Strategic Location and Investment

Malaysia captures 2.5% of the APAC market, valued at approximately $XX billion. The growth is driven by strategic investments in petrochemical facilities and a favorable business environment. Government initiatives like the National Chemical Industry Policy are promoting sustainable practices. Key industrial areas include Johor and Penang, which are attracting foreign investments and enhancing local production capabilities.

Thailand : Key Player in Southeast Asia

Thailand holds a 2.0% market share in the chemical intermediate sector, valued at around $XX billion. The market is driven by diverse applications in automotive, agriculture, and consumer goods. Government policies are focused on enhancing the chemical industry through investment incentives. Key regions like Rayong and Chonburi are industrial hubs, hosting major players like PTT Global Chemical.

Indonesia : Potential in Chemical Manufacturing

Indonesia accounts for 2.0% of the APAC market, valued at approximately $XX billion. The growth is driven by increasing domestic consumption and government initiatives to boost local manufacturing. Regulatory frameworks are evolving to support sustainable practices. Key regions like Java and Sumatra are central to the chemical industry, with local players expanding their production capabilities.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC captures 2.63% of the market, valued at around $XX billion. Growth is driven by varying demand across countries, influenced by local industries such as textiles, agriculture, and pharmaceuticals. Regulatory environments differ significantly, impacting market dynamics. Countries like Vietnam and the Philippines are emerging as key players, with increasing investments in chemical production.