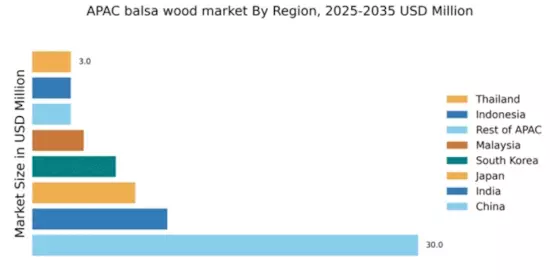

China : China's Unmatched Market Share

China holds a commanding 30.0% share of the APAC balsa wood market, valued at approximately $300 million. Key growth drivers include a booming construction sector, increasing demand for lightweight materials in aerospace, and government initiatives promoting sustainable forestry practices. The regulatory environment is supportive, with policies aimed at enhancing wood product standards and promoting eco-friendly materials. Infrastructure development, particularly in transportation and logistics, further boosts market accessibility and growth.

India : India's Growing Demand for Balsa

India accounts for 10.5% of the APAC balsa wood market, valued at around $105 million. The growth is driven by rising demand in the construction and model-making sectors, alongside government initiatives to boost local manufacturing. Consumption patterns are shifting towards eco-friendly materials, supported by regulatory frameworks promoting sustainable practices. The increasing urbanization and infrastructure projects are also significant contributors to market expansion.

Japan : Japan's Niche Balsa Wood Usage

Japan holds an 8.0% share of the APAC balsa wood market, valued at approximately $80 million. The market is driven by demand in the model-making and hobbyist sectors, where balsa wood is favored for its lightweight and easy-to-work properties. Regulatory policies encourage the use of sustainable materials, aligning with Japan's environmental goals. The country's advanced manufacturing capabilities also support high-quality balsa wood products.

South Korea : South Korea's Balsa Wood Innovations

South Korea captures 6.5% of the APAC balsa wood market, valued at about $65 million. The growth is fueled by innovations in the aerospace and automotive industries, where lightweight materials are increasingly essential. Government initiatives promoting research and development in sustainable materials further enhance market prospects. The competitive landscape features both local and international players, with a focus on high-quality production.

Malaysia : Malaysia's Growing Balsa Market

Malaysia represents 4.0% of the APAC balsa wood market, valued at around $40 million. The strategic location facilitates trade within the region, while local demand is driven by the construction and furniture sectors. Government policies supporting sustainable forestry and manufacturing practices are pivotal for market growth. The competitive landscape includes both domestic producers and international suppliers, enhancing market dynamics.

Thailand : Thailand's Eco-Friendly Balsa Market

Thailand holds a 3.0% share of the APAC balsa wood market, valued at approximately $30 million. The market is characterized by a growing emphasis on sustainable practices in balsa wood production, driven by both consumer demand and regulatory frameworks. Key applications include construction and crafts, with local initiatives promoting eco-friendly materials. The competitive landscape features a mix of local artisans and larger manufacturers.

Indonesia : Indonesia's Balsa Wood Abundance

Indonesia accounts for 3.0% of the APAC balsa wood market, valued at around $30 million. The country benefits from abundant natural resources, making it a key supplier of balsa wood. Growth drivers include increasing exports and local demand in construction and model-making sectors. Regulatory policies focus on sustainable harvesting practices, ensuring long-term resource availability. The competitive landscape includes both local producers and international companies.

Rest of APAC : Rest of APAC's Balsa Opportunities

The Rest of APAC region holds a 3.0% share of the balsa wood market, valued at approximately $30 million. This diverse market is characterized by varying demand across different countries, driven by local industries such as crafts, construction, and model-making. Regulatory frameworks are often less stringent, allowing for a mix of sustainable and traditional practices. The competitive landscape includes a variety of local and international players, catering to niche markets.