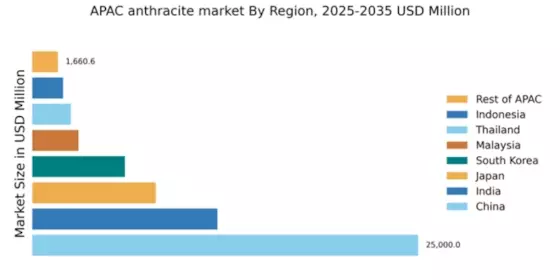

China : Unmatched Production and Demand Growth

China holds a commanding 55.5% market share in the APAC anthracite market, valued at $25,000.0 million. Key growth drivers include robust industrial demand, particularly in steel production and power generation. Government initiatives aimed at reducing carbon emissions are pushing for cleaner coal technologies, while infrastructure investments in rail and ports enhance distribution capabilities. The increasing urbanization and industrialization further fuel consumption patterns, making China a pivotal player in the anthracite market.

India : Industrial Expansion Fuels Consumption

India accounts for 17.5% of the APAC anthracite market, valued at $12,000.0 million. The growth is driven by the expanding manufacturing sector, particularly in cement and steel industries. Government policies promoting coal production and infrastructure development, such as the National Infrastructure Pipeline, are enhancing supply chains. The demand for anthracite is also rising due to its efficiency in energy generation, aligning with India's energy security goals.

Japan : Energy Transition and Sustainability Focus

Japan holds a 10.5% share of the APAC anthracite market, valued at $8,000.0 million. The market is characterized by a shift towards cleaner energy sources, with anthracite being used in specific industrial applications. Government regulations are promoting energy efficiency and reducing carbon footprints, influencing consumption patterns. The demand for high-quality anthracite remains stable, particularly in the steel and manufacturing sectors, driven by technological advancements.

South Korea : Technological Advancements Drive Growth

South Korea represents 7.5% of the APAC anthracite market, valued at $6,000.0 million. The growth is propelled by advancements in technology and a focus on high-efficiency coal usage. The government is implementing policies to enhance energy efficiency and reduce emissions, impacting consumption trends. The industrial sector, particularly shipbuilding and steel, remains a significant consumer of anthracite, supported by strong infrastructure and logistics networks.

Malaysia : Strategic Location for Trade Growth

Malaysia captures 3.5% of the APAC anthracite market, valued at $3,000.0 million. The market is driven by increasing demand in the energy sector and industrial applications. Government initiatives to boost local coal production and improve infrastructure are enhancing market accessibility. The strategic location of Malaysia facilitates trade with neighboring countries, making it a key player in the regional anthracite supply chain.

Thailand : Industrial Demand Shapes Market Trends

Thailand holds a 2.5% share of the APAC anthracite market, valued at $2,500.0 million. The growth is primarily driven by the industrial sector, particularly in power generation and manufacturing. Government policies aimed at energy diversification and sustainability are influencing consumption patterns. The competitive landscape includes local and international players, with a focus on enhancing supply chain efficiencies and reducing costs.

Indonesia : Resource Richness and Export Potential

Indonesia accounts for 1.5% of the APAC anthracite market, valued at $2,000.0 million. The market is characterized by abundant natural resources and growing export potential. Government initiatives to improve mining regulations and infrastructure are enhancing market dynamics. Key markets include Sumatra and Kalimantan, where local players are increasingly competing with international firms, particularly in the energy sector.

Rest of APAC : Varied Demand Across Smaller Markets

The Rest of APAC holds a 1.1% share of the anthracite market, valued at $1,660.6 million. This segment includes various smaller markets with unique demand drivers, such as energy security and industrial applications. Regulatory frameworks vary significantly, influencing consumption patterns. The competitive landscape is fragmented, with local players dominating, while international firms explore niche opportunities in specific industries.