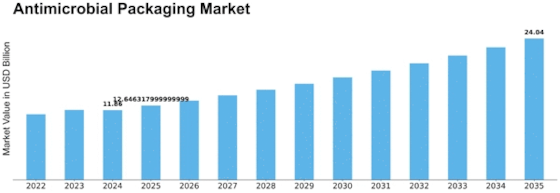

Antimicrobial Packaging Size

Antimicrobial Packaging Market Growth Projections and Opportunities

The antimicrobial packaging market is influenced by various factors that shape its dynamics and determine its performance. Antimicrobial packaging incorporates active agents or materials that inhibit the growth of microorganisms on packaged products, thereby extending shelf life and ensuring product safety. One of the primary market factors impacting the global antimicrobial packaging market is the increasing awareness of food safety and hygiene. With growing concerns about foodborne illnesses and food spoilage, consumers and regulatory bodies are emphasizing the importance of safe and hygienic packaging solutions. Antimicrobial packaging offers an effective solution to address these concerns by preventing the growth of bacteria, molds, and other pathogens on food products, driving its adoption in the food and beverage industry and contributing to market growth.

Although the food and beverage industry is the primary end-user of the antimicrobial packaging industry, the end-user such as the pharmaceutical industry, medical supplies, agricultural products, and other essentials are also intensively utilizing the antimicrobial packaging. The increasing awareness and the favorable government initiatives are some of the major drives of antimicrobial packaging market growth.

Moreover, technological advancements and innovations significantly influence the global antimicrobial packaging market. Manufacturers are constantly innovating to develop antimicrobial packaging solutions with improved performance, sustainability, and cost-effectiveness. For example, advancements in antimicrobial agents, such as silver nanoparticles and essential oils, enable manufacturers to incorporate effective antimicrobial properties into packaging materials without compromising product safety or quality. Additionally, innovations in packaging technologies, such as controlled-release systems and active packaging films, enhance the efficacy and longevity of antimicrobial packaging solutions, driving adoption in various industries.

Furthermore, regulatory factors play a crucial role in shaping the global antimicrobial packaging market. Regulations and standards related to food safety, hygiene, and packaging materials drive the adoption of antimicrobial packaging solutions that meet regulatory requirements. For example, regulations governing food contact materials, such as the Food Contact Materials Regulation (EC) No 1935/2004 in the European Union, mandate the use of packaging materials that are safe for food contact and do not transfer harmful substances to food products. Similarly, regulations related to product labeling and claims, such as the Food and Drug Administration (FDA) regulations in the United States, require accurate and transparent labeling of antimicrobial packaging products to ensure consumer safety and confidence.

Market dynamics such as supply chain considerations and technological advancements also impact the global antimicrobial packaging market. The antimicrobial packaging supply chain involves multiple stages, including the sourcing of raw materials, manufacturing of packaging components, integration of antimicrobial agents, and distribution to end-users. Disruptions at any stage of the supply chain, such as raw material shortages, transportation bottlenecks, or regulatory challenges, can affect the availability and pricing of antimicrobial packaging solutions. Additionally, advancements in antimicrobial packaging technologies, such as nanotechnology and biodegradable antimicrobial coatings, improve product safety and sustainability, driving adoption in the packaging industry.

Moreover, market factors such as globalization and trade policies influence the global antimicrobial packaging market. As antimicrobial packaging manufacturers expand their operations to new markets and regions, there is a growing demand for packaging solutions that comply with local regulatory requirements and cultural preferences. Additionally, trade policies, tariffs, and international agreements related to packaging materials and technologies can impact the competitiveness of antimicrobial packaging manufacturers in global markets, affecting market dynamics and pricing. Understanding these market factors and adapting manufacturing and distribution strategies accordingly is essential for antimicrobial packaging manufacturers to remain competitive in the dynamic and evolving global market.

Leave a Comment