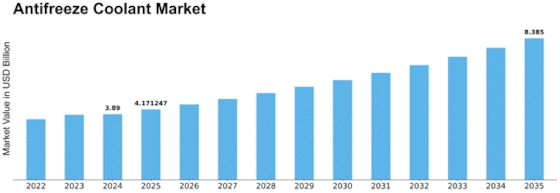

Antifreeze Coolant Size

Antifreeze Coolant Market Growth Projections and Opportunities

The Antifreeze Coolant market is subject to a variety of factors that collectively shape its dynamics. Understanding these elements is crucial for industry participants to make informed decisions and navigate the market effectively.

Automotive Industry Demand:

The primary driver for the Antifreeze Coolant market is the automotive industry, where these fluids are essential for regulating engine temperature and preventing overheating. Market dynamics are closely linked to trends in automotive production, vehicle sales, and maintenance practices. Extreme Weather Conditions:

Regions experiencing harsh winter conditions rely heavily on antifreeze coolant to prevent engine freezing. The demand for antifreeze coolant is influenced by climate patterns and weather conditions, with colder climates driving higher market demand. Technological Advancements in Automotive Engines:

Ongoing advancements in automotive engine technologies impact the formulation and requirements of antifreeze coolants. Companies investing in research and development to meet the evolving needs of modern engine systems contribute to market dynamics. Expansion of Electric and Hybrid Vehicles:

The growth of electric and hybrid vehicles influences the demand for specialized coolants to manage the thermal conditions of these advanced propulsion systems. Market dynamics are impacted by the shift towards alternative energy vehicles and the associated requirements for different coolant formulations. Industrial Applications:

Antifreeze coolants find applications beyond automobiles, including in industrial processes such as HVAC systems and manufacturing equipment. Market dynamics are influenced by trends in industrial production and the need for efficient temperature control in various applications. Environmental Regulations:

Stringent environmental regulations regarding the composition and disposal of coolant fluids impact the formulation and production practices of antifreeze coolants. Compliance with environmental standards is crucial for manufacturers to ensure market acceptance and meet regulatory requirements. Preventive Maintenance Practices:

The adoption of preventive maintenance practices by vehicle owners and industrial operators drives the regular use of antifreeze coolants to extend the lifespan of engines and equipment. Market dynamics are influenced by trends in maintenance habits and the awareness of the importance of coolant fluid in preserving engine performance. Global Economic Conditions:

Economic stability and growth rates in major economies influence automotive production and industrial activities, directly impacting the demand for antifreeze coolants. Economic downturns may lead to reduced automotive manufacturing and maintenance activities, affecting the overall market. Brand Loyalty and Reputation:

Brand loyalty and reputation play a significant role in the antifreeze coolant market, with consumers often choosing established and trusted brands. Companies that focus on building a positive brand image and providing reliable products enhance their competitiveness. Packaging and Distribution Practices:

Efficient packaging and distribution practices are essential for the widespread availability and accessibility of antifreeze coolants. Companies optimizing their supply chain, packaging solutions, and distribution networks contribute to market accessibility and customer satisfaction. Rising Awareness of Product Performance:

Growing awareness among consumers and industrial users about the importance of antifreeze coolants in maintaining engine efficiency influences purchasing decisions. Educational initiatives and marketing efforts that emphasize product performance and benefits impact market dynamics. Innovations in Formulations:

Ongoing innovations in coolant formulations, such as extended-life and eco-friendly options, impact consumer preferences and market trends. Companies that invest in developing new and improved formulations can gain a competitive edge in the market. Competitive Landscape and Pricing Strategies:

Intense competition among antifreeze coolant manufacturers leads to pricing strategies and product differentiation. Companies focusing on competitive pricing, quality assurance, and innovative solutions are better positioned to succeed in a crowded market.

Leave a Comment