Market Growth Projections

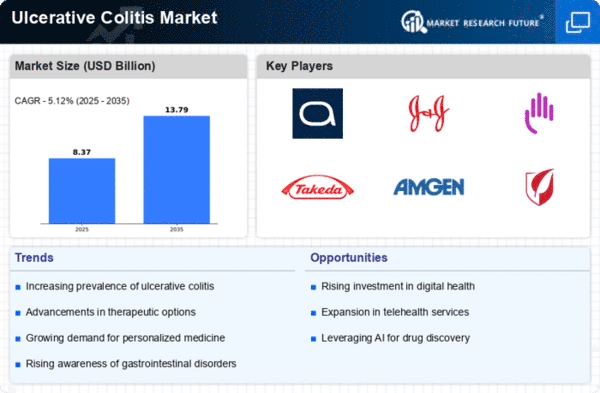

The Global Ulcerative Colitis Market Industry is poised for substantial growth, with projections indicating a compound annual growth rate (CAGR) of 5.12% from 2025 to 2035. This growth trajectory reflects the increasing demand for effective ulcerative colitis treatments and the ongoing advancements in medical research. The market's expansion is expected to be driven by a combination of factors, including rising prevalence rates, improved healthcare access, and the introduction of innovative therapies. As the industry evolves, stakeholders are likely to witness significant opportunities for investment and development, positioning the market for continued success in the coming years.

Growing Awareness and Education

Heightened awareness and education regarding ulcerative colitis play a pivotal role in shaping the Global Ulcerative Colitis Market Industry. Campaigns aimed at educating the public about the symptoms and management of this condition have led to earlier diagnosis and treatment. Organizations and healthcare providers are increasingly focusing on disseminating information about ulcerative colitis, which encourages individuals to seek medical advice. This proactive approach not only improves patient outcomes but also drives market growth as more patients are diagnosed and treated. The ongoing efforts to raise awareness are likely to sustain the momentum of the market in the coming years.

Increased Healthcare Expenditure

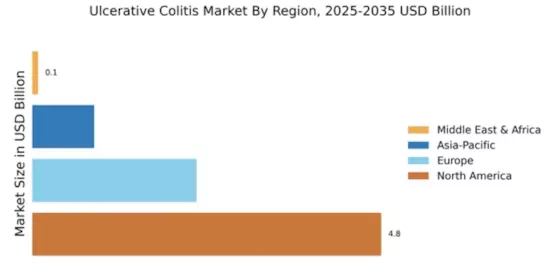

The rise in healthcare spending globally is a crucial driver for the Global Ulcerative Colitis Market Industry. As countries invest more in healthcare infrastructure and services, patients gain better access to diagnostic and therapeutic options for ulcerative colitis. In 2024, the market is projected to reach 7.96 USD Billion, reflecting the impact of increased healthcare budgets on disease management. This trend is particularly evident in developed nations, where healthcare systems prioritize chronic disease management. Furthermore, the emphasis on preventive care and early intervention strategies may lead to higher demand for ulcerative colitis treatments, thereby fostering market expansion.

Regulatory Support and Approvals

Regulatory support and streamlined approval processes for new treatments significantly impact the Global Ulcerative Colitis Market Industry. Regulatory agencies are increasingly prioritizing the review of therapies aimed at chronic conditions like ulcerative colitis, facilitating quicker access to innovative treatments. This trend is evident in the growing number of drug approvals, which enhances the treatment landscape for patients. As the market is projected to reach 13.8 USD Billion by 2035, the role of regulatory bodies in expediting the approval process is crucial for sustaining market growth. The favorable regulatory environment encourages pharmaceutical companies to invest in research and development, further enriching the market.

Advancements in Treatment Options

Innovations in treatment modalities significantly influence the Global Ulcerative Colitis Market Industry. The introduction of biologics and targeted therapies has transformed the management of ulcerative colitis, offering patients more effective and personalized treatment options. For instance, the approval of new biologic agents has expanded the therapeutic landscape, providing alternatives for patients who do not respond to conventional therapies. These advancements not only improve patient outcomes but also drive market growth as healthcare providers adopt these novel treatments. The ongoing research and development efforts in this area suggest a promising future for the industry, with potential new therapies entering the market.

Rising Prevalence of Ulcerative Colitis

The increasing incidence of ulcerative colitis globally drives the Global Ulcerative Colitis Market Industry. Recent estimates suggest that approximately 1.6 million individuals in the United States are affected by this chronic condition, with similar trends observed in Europe and Asia. The growing awareness of gastrointestinal disorders, coupled with improved diagnostic techniques, contributes to the rising number of diagnosed cases. This trend is expected to propel the market, as more patients seek effective treatments and management options. As the population ages and lifestyle factors evolve, the demand for ulcerative colitis therapies is likely to increase, further expanding the market.