Regulatory Pressures and Compliance

Regulatory pressures are increasingly shaping the landscape of the Anti-Counterfeit Packaging for Food and Beverage Market. Governments worldwide are implementing stringent regulations to combat counterfeit goods, particularly in the food and beverage sector. Compliance with these regulations is becoming essential for manufacturers, as non-compliance can result in hefty fines and reputational damage. For instance, the Food and Drug Administration has introduced guidelines that mandate specific labeling and packaging requirements to ensure product authenticity. This regulatory environment is driving investments in anti-counterfeit technologies, as companies seek to align with compliance standards and protect their market share.

Increasing Incidence of Counterfeit Products

The rising incidence of counterfeit products in the food and beverage sector is a critical driver for the Anti-Counterfeit Packaging for Food and Beverage Market. Reports indicate that counterfeit food products can lead to severe health risks, prompting regulatory bodies to enforce stricter packaging standards. The World Health Organization has highlighted that counterfeit food and beverages can account for up to 10% of the global market. This alarming statistic underscores the urgent need for effective anti-counterfeit packaging solutions, as companies strive to safeguard their reputations and maintain consumer trust.

Sustainability Trends in Packaging Solutions

Sustainability trends are influencing the Anti-Counterfeit Packaging for Food and Beverage Market, as consumers and businesses alike prioritize eco-friendly practices. The integration of sustainable materials in anti-counterfeit packaging not only addresses environmental concerns but also enhances brand image. Research suggests that the market for sustainable packaging is expected to reach USD 500 billion by 2027, indicating a robust growth trajectory. Companies are increasingly investing in sustainable anti-counterfeit solutions, recognizing that environmentally responsible practices can serve as a competitive advantage while simultaneously combating counterfeiting.

Consumer Awareness and Demand for Authenticity

Consumer awareness regarding the risks associated with counterfeit food and beverages is a significant driver for the Anti-Counterfeit Packaging for Food and Beverage Market. As consumers become more informed about the potential dangers of counterfeit products, their demand for transparency and authenticity in packaging is increasing. Surveys indicate that over 70% of consumers are willing to pay a premium for products that guarantee authenticity. This shift in consumer behavior is compelling manufacturers to adopt advanced anti-counterfeit packaging solutions, as they aim to meet the growing expectations for product integrity and safety.

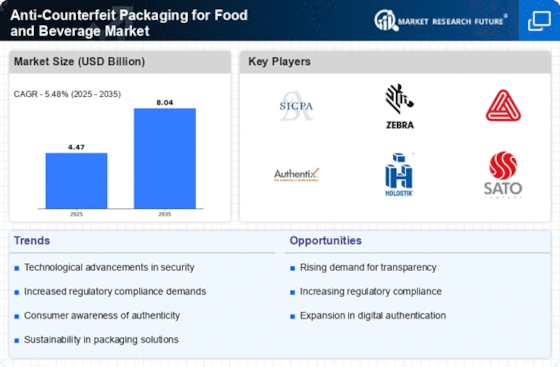

Technological Innovations in Anti-Counterfeit Packaging

The Anti-Counterfeit Packaging for Food and Beverage Market is experiencing a surge in technological innovations. Advanced technologies such as RFID, QR codes, and holograms are being integrated into packaging solutions to enhance product authentication. These innovations not only deter counterfeiters but also provide consumers with a means to verify product authenticity. According to recent data, the adoption of RFID technology in packaging is projected to grow at a compound annual growth rate of 20% over the next five years. This trend indicates a strong market demand for sophisticated anti-counterfeit solutions, as manufacturers seek to protect their brands and ensure consumer safety.