Top Industry Leaders in the Anionic Surfactants Market

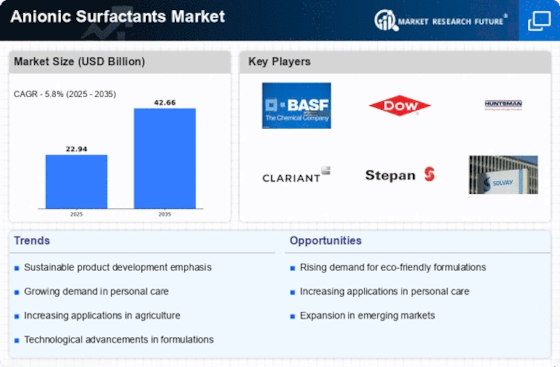

The anionic surfactants market, a key ingredient in countless household and industrial products, is a dynamic and ever-evolving landscape. With a projected CAGR of 5.80% for the next eight years, it's a competitive whirlpool where established giants and nimble newcomers vie for market share. To navigate this turbulent terrain, let's dive into the strategies, factors, news, and recent developments shaping this exciting industry.

Strategies Adopted by Market Titans:

-

Innovation & Sustainability: Leading players like BASF, Stepan Chemical, and Huntsman Corporation are investing heavily in R&D, focusing on bio-based, readily biodegradable, and performance-enhancing surfactants. Recent examples include Stepan's launch of its ALPHA-STEP® 300 series of readily biodegradable alkyl sulfate surfactants in June 2023. -

Market Diversification: Companies are expanding their reach beyond traditional segments like household cleaning to cater to burgeoning industries like personal care, pharmaceuticals, and oil & gas. In September 2023, Croda International announced its acquisition of the surfactant business of Perstorp Holding AB, strengthening its presence in the personal care sector. -

Vertical Integration: Gaining control over raw materials and production processes is another key strategy. In August 2023, Wilmar International expanded its oleochemical production capacity in Indonesia, securing a reliable supply of feedstock for its anionic surfactant production. -

Partnerships & Acquisitions: Collaborations and mergers are common, allowing companies to access new technologies, markets, and distribution channels. In July 2023, Kao Corporation formed a strategic alliance with Mitsubishi Chemical Corporation to develop and commercialize next-generation surfactants for industrial applications.

Factors Shaping Market Share:

-

Regional Growth: Emerging economies like China and India are driving significant demand, while mature markets like Europe and North America are experiencing slower growth. This necessitates regional customization of products and strategies. -

Environmental Regulations: Stringent regulations on environmental impact are pushing manufacturers towards greener alternatives, creating opportunities for bio-based and readily biodegradable surfactants. -

Fluctuating Raw Material Prices: The volatile prices of key raw materials like petroleum and vegetable oils pose a challenge for manufacturers, impacting production costs and profitability. -

Consumer Preferences: Growing awareness of sustainability and health concerns are influencing consumer choices, favoring natural and eco-friendly surfactants.

Key Companies in the Anionic Surfactants market include

-

AkzoNobel NV

-

BASF SE

-

Clariant AG

-

Croda International PLC

-

Dowdupont

-

Evonik Industries AG

-

Galaxy Surfactants

-

Huntsman Corporation

-

Kao Corporation

-

Stepan Company

Recent Development

-

October 2023: The European Chemicals Agency (ECHA) proposed a restriction on the use of certain alkylphenol ethoxylates (APEOs) in textiles and leather, impacting the market for alternative surfactants. -

November 2023: The US Environmental Protection Agency (EPA) announced new regulations on the discharge of perfluorooctanoic acid (PFOA) and perfluorooctanesulfonic acid (PFOS) from industrial facilities, leading to increased demand for PFOA-free and PFOS-free surfactants.