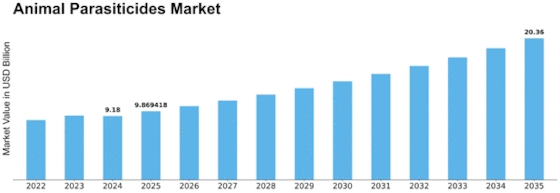

Animal Parasiticides Size

Animal Parasiticides Market Growth Projections and Opportunities

animal parasiticides market is influenced by a multitude of market factors that collectively shape its dynamics and growth. One primary factor driving the market is the increasing global population of companion animals and livestock. As the number of pets and farm animals rises, so does the risk of parasitic infections. This demographic shift contributes to a continuous demand for effective animal parasiticides to ensure the health and well-being of animals, stimulating market growth.

Government regulations and policies constitute a crucial market factor, especially in the animal health and pharmaceutical industries. Regulatory oversight influences the development, approval, and commercialization of animal parasiticides. Stringent guidelines regarding product safety, efficacy, and proper usage are essential considerations for manufacturers, impacting their strategies and market positioning. Compliance with these regulations is imperative for market players to navigate and succeed in the industry.

The prevalence of parasitic infections in animals is a significant factor influencing the demand for animal parasiticides. Parasites pose a constant threat to the health and productivity of animals, affecting both companion animals and livestock. The need for effective prevention and treatment of parasitic infections creates a consistent demand for parasiticide products across diverse segments of the veterinary healthcare industry, contributing to the market's sustained growth.

Technological advancements and innovations in veterinary medicine are key market factors shaping the animal parasiticides sector. Continuous research and development efforts lead to the introduction of new and improved formulations, delivery methods, and diagnostic tools. These innovations enhance the efficacy, safety, and convenience of parasiticides, providing veterinarians and animal owners with a range of options to address specific parasitic challenges. The integration of advanced technologies contributes to market competitiveness and stimulates overall market growth.

Market dynamics are also influenced by the increasing awareness of zoonotic diseases. Diseases that can be transmitted between animals and humans highlight the interconnectedness of animal and public health. This awareness has led to a proactive approach to prevent the spread of zoonotic diseases, underscoring the importance of controlling parasitic infections in animals. The demand for effective parasiticides as a preventive measure is heightened, reflecting broader public health concerns.

Globalization and international trade play a significant role in shaping market factors within the animal parasiticides sector. The movement of animals across borders increases the risk of introducing and spreading parasitic infections. To address this challenge, market players must navigate international trade regulations, regional variations in parasite prevalence, and diverse customer needs. Adapting products to different markets and complying with global standards are essential considerations for companies operating in the global animal parasiticides market.

Market consolidation and strategic partnerships are pivotal market factors influencing the animal parasiticides sector. The industry has witnessed mergers, acquisitions, and collaborations among key players seeking to enhance their product portfolios, expand market reach, and leverage synergies. These strategic moves impact market competitiveness, research capabilities, and the ability to address a broad spectrum of parasitic infections, ultimately shaping the overall dynamics of the animal parasiticides market.

Economic factors, including the affordability and accessibility of animal parasiticides, are critical considerations in determining market dynamics. The cost of parasiticides, particularly for large-scale livestock operations, influences purchasing decisions. Balancing the economic viability of products with their efficacy is essential for market players to cater to the diverse needs of animal owners, farmers, and veterinarians.

In conclusion, the animal parasiticides market is influenced by a combination of factors, including the global population of animals, government regulations, prevalence of parasitic infections, technological innovations, awareness of zoonotic diseases, international trade dynamics, market consolidation, and economic considerations. The continuous evolution of these factors collectively shapes the landscape of the animal parasiticides market, highlighting the need for adaptability and strategic decision-making by companies operating in this dynamic and essential segment of the veterinary healthcare industry.

Leave a Comment