Market Share

Anesthesia Delivery Devices Market Share Analysis

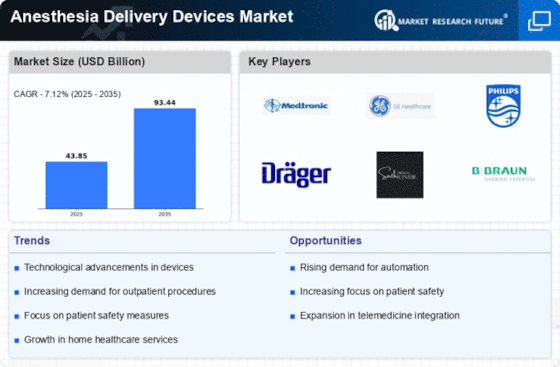

In the ever-evolving landscape of healthcare, the Anesthesia Delivery Devices Market has witnessed a dynamic interplay of market share positioning strategies among key industry players. These strategies are crucial as they directly impact a company's competitive standing and influence its ability to meet the diverse needs of healthcare professionals and patients alike.

One prevalent approach to securing market share in the Anesthesia Delivery Devices Market involves product innovation and technological advancements. Companies invest heavily in research and development to introduce cutting-edge devices that offer enhanced safety, efficiency, and patient comfort during anesthesia administration. By staying at the forefront of technological breakthroughs, a company can differentiate itself, attract healthcare providers seeking state-of-the-art solutions, and consequently capture a significant share of the market.

Strategic partnerships and collaborations constitute another pivotal facet of market share positioning. Given the complexity of the healthcare industry, collaboration with other key stakeholders, such as hospitals, research institutions, and pharmaceutical companies, can be a game-changer. Joint ventures or alliances enable companies to pool resources, share expertise, and leverage each other's strengths to develop comprehensive solutions that cater to the evolving demands of the Anesthesia Delivery Devices Market. Through strategic partnerships, companies can broaden their market reach and solidify their position in the competitive landscape.

Pricing strategies also play a crucial role in determining market share within the Anesthesia Delivery Devices Market. In a landscape where cost-effectiveness and value for money are paramount considerations, companies often adopt pricing strategies that strike a balance between affordability and quality. Some choose to position themselves as providers of cost-effective solutions, targeting price-sensitive segments of the market. Others opt for a premium pricing model, positioning their products as high-end, technologically advanced options for healthcare facilities willing to invest in top-tier anesthesia delivery devices.

Geographical expansion is yet another dimension of market share positioning. Companies strategically target regions with growing healthcare needs and increasing demand for anesthesia delivery devices. By expanding their presence globally, they can tap into new markets, diversify their customer base, and mitigate risks associated with dependence on specific regions. This approach requires an understanding of local regulations, cultural nuances, and healthcare infrastructure to effectively penetrate and establish a stronghold in diverse markets.

Moreover, a focus on customer education and support is integral to securing and expanding market share. Anesthesia delivery devices are intricate pieces of medical equipment, and healthcare professionals require in-depth knowledge to utilize them effectively. Companies that invest in comprehensive training programs, user-friendly manuals, and responsive customer support services enhance their reputation and foster long-term relationships with healthcare providers. By prioritizing customer education, companies not only ensure the optimal use of their products but also build trust and loyalty within the market.

Leave a Comment