Market Analysis

In-depth Analysis of Anemia Drugs Market Industry Landscape

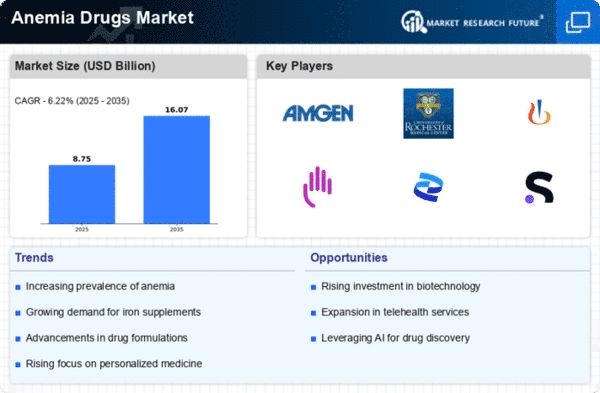

The market dynamics of anemia drugs reflect a complex interplay of factors, encompassing the prevalence of anemia, advancements in medical treatments, and the competitive landscape within the pharmaceutical industry. Anemia drugs aim to address a condition characterized by a deficiency of red blood cells or hemoglobin, and understanding the market dynamics is crucial for stakeholders involved in the development, manufacturing, and distribution of these therapies. Anemia, the incidence of which both regionally and globally, is a fundamental factor in the direction the market is going. The improvement of the general knowledge about anemia causes and the need to act, as soon as possible, helps to accelerate the increase in the requirement for efficient anemia drugs. The market size of anemia drugs is greatly influenced by the demographic aspect, such as the ageing population of the human race. As the elderly cohort increases, so will the chances of both anemic and related conditions so as to create the dynamics in the pharmaceutical industry that will shape the companies to produce for this demographic. Anexemia could be a product of different initial causes, such as nutritional deficiencies, chronic diseases, and genetic abnormalities. The wide variety of underlying mechanisms of anemia results in the development of multiple products to ease the marketing pulling and pharmaceutical companies that must focus on specific subtypes and causes. Repeated improvement in researches in medicine and the development of production of drugs plays the leading role in the development of medicines for anemia. Novel formulation, delivery techniques and therapeutic approaches increasing the activity and safety of these drugs alter the competition of the market. One of the most important iron deficiency is the cause of anemia and the prevalence of drugs targeting this criterion is still very high. The reasons for many anemia drugs keeping changing because of the widespread iron deficiency anemia and the motion of the iron supplement product. Role of economy, notably healthcare expenditures and finance in market performance, influences market demand. A drug treating anemia has to go through the process of effectiveness and cost determination to allow its availability to those patients who are hard-to-treat. Stringent regulatory standards and approval processes are always the drivers of the market of anemia drugs. A key factor is aregulatory compliance, and successful approvals may be regarded as a determinant of the momentum in product sales by both healthcare professionals and patients.

The globalization of pharmaceutical markets impacts the availability and distribution of anemia drugs. As healthcare infrastructure improves in emerging markets, the demand for anemia treatments increases, influencing market dynamics on a global scale. The anemia drugs market faces challenges such as potential side effects, competition from alternative therapies, and the need for patient education. Mitigating these risks is essential for sustained growth and success in a market that is constantly evolving.

Leave a Comment