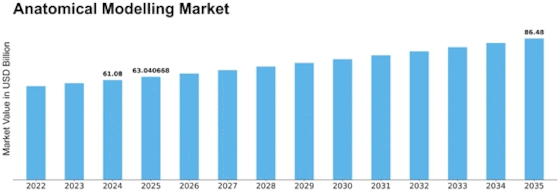

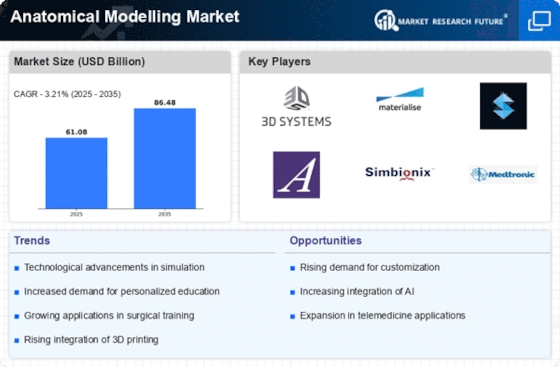

Anatomical Modelling Size

Anatomical Modelling Market Growth Projections and Opportunities

Veterinary software is a helpful tool used in veterinary practices to streamline daily tasks and provide valuable business insights for decision-making. It offers various features such as reducing paperwork, improving productivity, and enhancing client communication. This software is widely used in animal hospitals, research labs, and educational institutions. The increasing ownership of companion animals, rise in animal diseases, and growth in pet insurance and animal health expenditure have contributed to the rising demand for veterinary software, driving market growth. However, challenges such as limited government support for software implementation and reluctance to adopt new technologies are hindering market growth at the country level.

Veterinary software plays a crucial role in managing the operations of veterinary practices, including appointment scheduling, medical records management, billing, inventory management, and more. It helps in maintaining an organized workflow and provides valuable insights into the business performance. One of the key benefits of veterinary software is the reduction of paperwork and administrative tasks, allowing the staff to focus more on animal care and client interaction. Additionally, it enhances productivity by automating repetitive tasks and streamlining workflow processes.

Moreover, veterinary software facilitates better client communication by enabling easy access to medical records, appointment scheduling, and reminders for follow-up care. This helps in building strong relationships with pet owners and ensures comprehensive care for their animals. The software is extensively used in animal hospitals, research laboratories, and educational institutions to manage patient records, laboratory data, and educational resources. It also assists in conducting research, analyzing data, and sharing information related to animal health and treatment.

The growing trend of companion animal ownership has led to an increased need for efficient management of veterinary practices, driving the demand for veterinary software. Furthermore, the rising prevalence of animal diseases has necessitated the use of advanced tools for accurate diagnosis, treatment, and monitoring of animal health, thus boosting the adoption of veterinary software. Additionally, the surge in pet insurance coverage and increased expenditure on animal health and wellness have further propelled the demand for veterinary software. Pet owners are increasingly investing in comprehensive healthcare services for their animals, leading to a greater requirement for efficient and advanced management tools in veterinary practices.

Leave a Comment