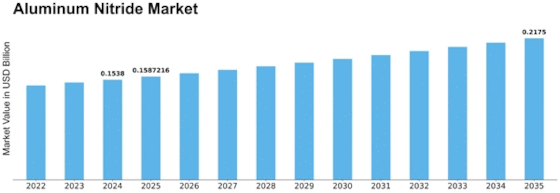

Aluminum Nitride Size

Aluminum Nitride Market Growth Projections and Opportunities

The 2022 Aluminum Nitride Market was worth USD 0.145 billion. The aluminum nitride industry is expected to increase from USD 0.149 Billion in 2023 to USD 0.192 Billion in 2032, a CAGR of 3.20%.

Aluminum Nitride manufacturing technology drives market dynamics. AlN purity, production processes, and new uses for this ceramic material are under development. Advanced sintering and powder metallurgy maximize Aluminum Nitride characteristics for industrial applications.

The Aluminum Nitride market is affected by semiconductor and electronic component advances in the electronics sector. High heat conductivity materials like Aluminum Nitride are in demand as electronics get smaller and more powerful. The market supports these developments by offering heat management components for electrical equipment, assuring reliability and performance.

Government electronics production and material standards affect the Aluminum Nitride industry. Manufacturers must follow electronic component safety and performance criteria. Regulations encouraging ecologically friendly materials and production can drive Aluminum Nitride use in electronics manufacturing.

Consumer demand for electronics and industrial technology spending affect the Aluminum Nitride market. Aluminum Nitride is used in many applications due to economic stability and electronics manufacturing investment. As industries modify production and material procurement, economic downturns or consumer electronics demand variations may affect the market.

Aluminum Nitride market dynamics are shaped by electronics and ceramics competition. Companies spend in R&D to improve Aluminum Nitride characteristics, investigate new applications, and fulfill electronics makers' changing demands. Building strong connections with semiconductor businesses, electrical device makers, and research institutes is essential for market share and Aluminum Nitride acceptance.

World commerce and supply chains affect the Aluminum Nitride market. Raw material sources, production sites, transportation costs, and worldwide demand for electronic components and ceramics affect Aluminum Nitride availability and pricing.

Environmental factors shape the Aluminum Nitride market. Manufacturers of Aluminum Nitride seek green production and sourcing as industries prioritize sustainability and environmental responsibility. The ceramic manufacturing industry's attempts to follow eco-friendly trends and limit its environmental effect show its dedication to responsible material selections.

Market growth is driven by consumer education about Aluminum Nitride's electronics advantages. Demand for Aluminum Nitride is projected to rise as electronics enthusiasts, engineers, and manufacturers learn about its thermal management and high-performance benefits. Educational programs, industry conferences, and communication efforts help spread information and build confidence in Aluminum Nitride in electronic applications."

Leave a Comment