Evolving Consumer Preferences

Evolving consumer preferences are driving changes within the Alternative Lending Platform Market. As consumers become more tech-savvy, they increasingly favor online lending solutions that offer convenience and speed. The demand for user-friendly interfaces and seamless application processes is paramount. Data shows that platforms providing a streamlined digital experience have witnessed a 40% rise in user engagement. This shift in consumer behavior suggests that alternative lending platforms must continuously innovate to meet the expectations of a modern clientele. By adapting to these preferences, platforms can enhance customer satisfaction and loyalty, ultimately leading to sustained growth in the competitive lending landscape.

Regulatory Changes and Compliance

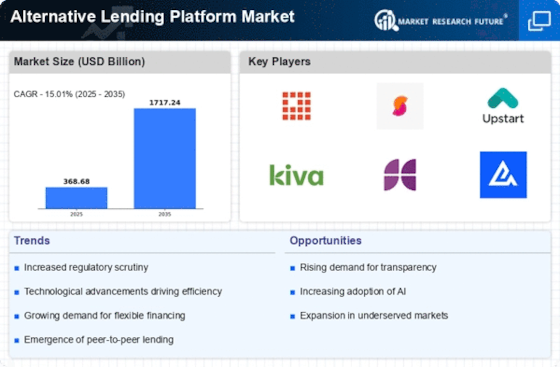

Regulatory changes are shaping the landscape of the Alternative Lending Platform Market, as governments worldwide seek to establish frameworks that ensure consumer protection while fostering innovation. Recent legislative efforts have aimed at creating a balanced environment for alternative lenders, which may lead to increased legitimacy and trust in the sector. Compliance with these regulations can enhance the credibility of alternative lending platforms, potentially attracting more borrowers. As the regulatory landscape evolves, platforms that proactively adapt to these changes are likely to gain a competitive edge. This dynamic environment presents both challenges and opportunities for alternative lenders as they navigate the complexities of compliance while striving for growth.

Technological Advancements in Lending

Technological advancements are reshaping the Alternative Lending Platform Market, enabling platforms to enhance their service offerings. The integration of artificial intelligence and machine learning algorithms allows for more accurate credit assessments and risk evaluations. This technological evolution not only streamlines the lending process but also reduces operational costs, making it more feasible for platforms to offer competitive rates. Recent statistics suggest that platforms utilizing advanced technology have seen a 30% increase in loan approval rates. As technology continues to evolve, it is expected that alternative lending platforms will further refine their processes, thereby attracting a broader customer base and solidifying their position in the financial services sector.

Growing Financial Inclusion Initiatives

The Alternative Lending Platform Market is significantly influenced by growing financial inclusion initiatives aimed at underserved populations. Many individuals and small businesses lack access to traditional banking services, creating a substantial market opportunity for alternative lenders. By leveraging technology, these platforms can reach borrowers who may have been previously excluded from the financial system. Recent reports indicate that alternative lending has contributed to a 15% increase in loan accessibility for marginalized communities. This focus on financial inclusion not only addresses social equity but also expands the customer base for alternative lenders, fostering a more diverse and resilient lending environment.

Increased Demand for Flexible Financing

The Alternative Lending Platform Market is experiencing a surge in demand for flexible financing options. As traditional banks impose stringent lending criteria, borrowers are increasingly turning to alternative platforms that offer more lenient terms. This shift is particularly evident among small and medium-sized enterprises (SMEs) that require quick access to capital. According to recent data, alternative lending has grown by approximately 25% in the last year, indicating a robust appetite for diverse financing solutions. The ability to provide tailored loan products that meet the unique needs of borrowers positions alternative lending platforms as a vital player in the financial ecosystem. This trend is likely to continue as more individuals and businesses seek out innovative financing methods that align with their specific circumstances.