Alcohol Packaging Size

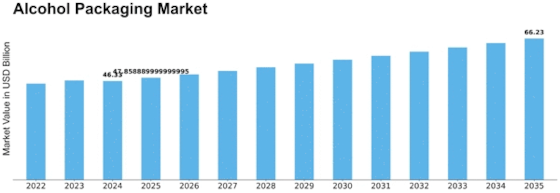

Alcohol Packaging Market Growth Projections and Opportunities

Global alcoholic beverage consumption is a major factor. Alcohol container makers must respond to changing alcoholic drink demand. Due to the expansion of craft brewers and distilleries, artisanal beverage packaging is in demand.

Government restrictions and policies also affect alcohol packaging. Labeling, safety, and environmental laws on packaging materials might influence corporate decisions. Compliance with these standards is lawful and essential to consumer trust.

Consumer tastes and behavior shape alcohol packaging. Consumer retention depends on packaging design, material selection, and branding. As e-commerce grows, packaging must be acceptable for online sale to ensure items reach consumers in good condition. Packaging producers develop and adapt to market demands because convenience, portability, and visual appeal impact consumer decisions.

Another important element is alcohol packaging market competition. Industry actors include package makers, designers, and suppliers. Technology and packaging advances provide firms an edge. A company's success in this competitive industry depends on its manufacturing efficiency, cost-effectiveness, and capacity to adapt packaging.

Alcohol packaging market success also depends on economic variables. Economic stability, disposable income, and consumer spending patterns affect alcoholic beverage demand and packaging. Economic changes need industrial strategy adjustments. Globalization and international commerce affect the supply chain, affecting packaging raw material availability and cost.

Technology has transformed alcohol packaging. Smart labels and innovative printing technologies improve packaging functionality and attractiveness. RFID tags and QR codes are used for product authentication and traceability to prevent counterfeiting and protect the supply chain. These technologies enhance user experience and alcohol packaging efficiency.

Health and fitness themes have also affected alcohol packaging. A growing knowledge of health-conscious consumer choices drives demand for packaging that conveys nutritional information, encourages responsible drinking, and supports a better lifestyle. Wellness customers like packaging that shows manufacturing transparency and authenticity."

Leave a Comment