Market Trends

Key Emerging Trends in the Airport Information Systems Market

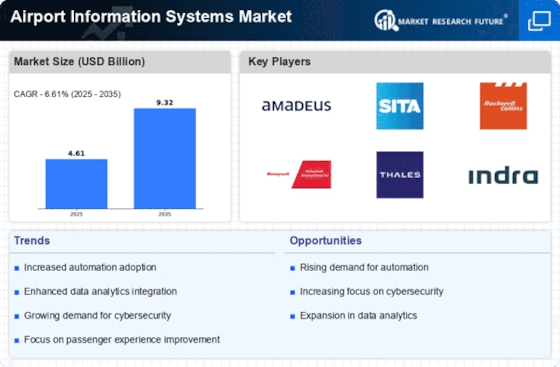

The Airport Information Systems (AIS) industry is showing signs of digital revolution and technical breakthroughs in aviation. The market is moving toward cloud-based solutions. Airports are using cloud computing to improve information system efficiency and scalability. Cloud-based AIS provides real-time data, simplified operations, and cost-effectiveness, helping airports handle massive amounts of data and react to changing operational demands. Integration and interoperability are key Airport Information Systems industry trends. Airports are emphasizing seamless information system integration to improve performance. AIS components like PPS, BHS, and FIDS may be integrated to create a unified ecosystem at airports. Interoperability ensures data flows easily across systems, improving operational efficiency and passenger experience. Biometric technology is growing in Airport Information Systems, notably for passenger processing. AIS is using biometrics like face recognition and fingerprint scanning to simplify check-in and boarding. This trend checks passengers' identities to increase security, minimize wait times, and boost airport efficiency. In the AIS industry, cybersecurity is becoming more important. With airport operations digitizing and using networked technology, protecting sensitive data from cyberattacks is crucial. To safeguard their information systems and crucial airport operations, airports are investing in enhanced encryption, threat detection, and secure communication protocols. Airport Information Systems are being influenced by mobile technology's passenger experience transformation. Mobile apps and self-service kiosks are being incorporated with AIS to provide passengers real-time information, self-check-in, and tailored alerts. By minimizing check-in queues, this improves passenger pleasure and airport efficiency. Conclusion, the Airport Information Systems market is changing with the aviation industry. Cloud usage, integration and interoperability, smart airport efforts, biometric technology, cybersecurity, sustainability, and mobile technology integration are transforming AIS. Airports are investing in technology-driven solutions to improve operational efficiency and passenger experience, positioning the industry for additional innovation and adaption to satisfy aviation sector demands.

Leave a Comment