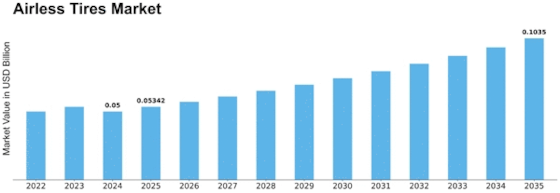

Airless Tires Size

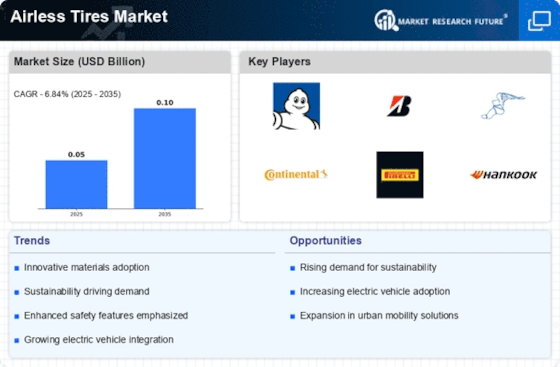

Airless Tires Market Growth Projections and Opportunities

The global airless tires market is poised for substantial growth, driven by a confluence of factors that are reshaping the dynamics of the tire industry. As environmental concerns and the quest for fuel efficiency gain prominence, coupled with stringent government regulations on tire labeling, the adoption of airless tires is witnessing a surge. Additionally, the trend towards eliminating spare tires is further propelling the market forward, creating a landscape where innovation and sustainability converge.

The segmentation of the airless tires market unveils a nuanced understanding of the various elements contributing to its growth.

Type Segmentation: The market is divided into radial tires and bias tires. In 2019, the radial tires segment held the lion's share, commanding 85.77% of the market with a value of USD 34.7 million. Projections indicate a robust Compound Annual Growth Rate (CAGR) of 17.76% for radial tires during the forecast period. This dominance signifies the preference for radial tires, known for their enhanced performance, improved fuel efficiency, and overall better driving experience.

Material Segmentation: The materials shaping airless tires are primarily categorized into rubber and plastic. In 2019, the plastic segment claimed the majority share, representing 73.35% of the market with a value of USD 29.7 million. With an anticipated CAGR of 18.55% over the forecast period, plastic continues to drive innovation in airless tire manufacturing, balancing durability, and weight considerations. Tire Size Segmentation: The diversity in vehicle sizes is addressed through segmentation into tire sizes, ranging from <20 inches to >35 inches. The 26-30 inches segment led the market in 2019, holding a substantial share of 38.45% with a value of USD 15.6 million. Projections suggest a robust CAGR of 19.30% for this segment, reflecting the demand for airless tires across various vehicle categories.

Vehicle Type Segmentation: Airless tires cater to diverse vehicle types, including two-wheelers, passenger cars, light/heavy industrial/commercial vehicles, and trucks & buses. In 2019, the light/heavy industrial/commercial vehicles segment accounted for a significant market share of 44.57%, with a value of USD 18.0 million. With an expected CAGR of 15.50%, this segment remains a key driver of the airless tires market, especially in the industrial and commercial transportation sectors.

Sales Channel Segmentation: Sales channels, encompassing OEM and aftermarket, play a pivotal role in the distribution and adoption of airless tires. The OEM segment dominated in 2019, claiming a market share of 91.18% with a value of USD 36.9 million. The OEM segment is poised to continue its dominance with a projected CAGR of 17.47%, highlighting the integral role of original equipment manufacturers in the proliferation of airless tires.

Regional Outlook: In terms of regional distribution, Asia-Pacific led the charge in 2019, commanding a market share of 36.89% with a value of USD 14.9 million. Projections for the region indicate a robust CAGR of 17.25% over the forecast period, underscoring the region's pivotal role in the global airless tires market. Factors such as rapid urbanization, increasing vehicle ownership, and a burgeoning demand for sustainable transportation solutions contribute to Asia-Pacific's significant market share.

Leave a Comment