Aircraft Weapons Size

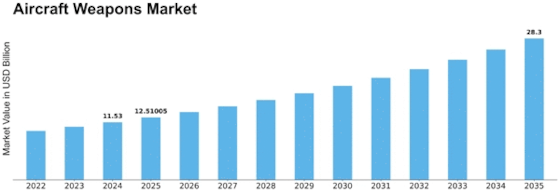

Aircraft Weapons Market Growth Projections and Opportunities

The aircraft weapons market is significantly influenced by several key factors that drive its growth and evolution. One crucial factor is the changing geopolitical landscape and security threats worldwide. With increasing tensions and conflicts in various regions, governments and defense organizations are prioritizing investments in military capabilities to deter aggression and protect national security interests. As a result, there is a growing demand for advanced aircraft weapons systems, including missiles, bombs, guns, and other munitions, to enhance the combat capabilities of military aircraft and ensure readiness for a range of mission scenarios, from air superiority to ground attack and strategic deterrence.

Moreover, technological advancements play a crucial role in shaping the aircraft weapons market. Manufacturers and defense contractors are continually innovating and developing new technologies to improve the performance, precision, and lethality of aircraft weapons systems. This includes advancements in guidance systems, target acquisition sensors, propulsion technologies, and warhead designs that enhance the effectiveness and reliability of weapons systems in challenging operational environments. Additionally, the integration of network-centric warfare capabilities, such as data fusion, situational awareness, and cooperative engagement, enables aircraft weapons to operate more effectively as part of integrated air and missile defense systems, driving market demand for advanced weapon systems.

Furthermore, defense budgets and procurement priorities influence market dynamics in the aircraft weapons sector. Defense spending levels and investment priorities vary across countries and regions, depending on strategic threats, military alliances, and budget constraints. Countries with larger defense budgets and ambitious modernization programs tend to invest more heavily in acquiring advanced aircraft weapons systems to maintain technological superiority and deter potential adversaries. Additionally, defense procurement policies, offset requirements, and industrial partnerships play a significant role in shaping market dynamics, as governments seek to support domestic defense industries, enhance technological capabilities, and foster innovation in the aerospace and defense sectors.

Additionally, evolving mission requirements and operational concepts drive market growth and innovation in the aircraft weapons sector. As military roles and missions evolve, there is a growing demand for versatile, multi-role aircraft weapons systems that can adapt to a wide range of mission scenarios and operational environments. Modern aircraft weapons are designed to provide flexibility, scalability, and interoperability, enabling military forces to respond effectively to dynamic and unpredictable threats. Moreover, the concept of multi-domain operations, which integrates air, land, sea, space, and cyberspace capabilities, drives market demand for integrated weapons systems that can operate seamlessly across different domains and support joint and coalition operations.

Moreover, the proliferation of unmanned and autonomous aircraft platforms creates new opportunities and challenges for the aircraft weapons market. As unmanned aerial vehicles (UAVs) and unmanned combat aerial vehicles (UCAVs) become increasingly prevalent in military operations, there is a growing demand for specialized weapons systems designed for unmanned platforms. Manufacturers are developing lightweight, compact, and modular weapons solutions that can be integrated with UAVs and UCAVs to provide precision strike capabilities, intelligence, surveillance, and reconnaissance (ISR), and electronic warfare (EW) support. Additionally, the development of autonomous weapons systems, such as loitering munitions and swarming drones, presents new challenges and opportunities for defense planners and industry stakeholders, driving market innovation and investment in next-generation weapon technologies.

Furthermore, the impact of emerging technologies, such as directed energy weapons (DEWs) and hypersonic weapons, is reshaping the aircraft weapons market. DEWs, including laser and high-powered microwave systems, offer potential advantages in terms of precision, speed, and cost-effectiveness compared to traditional kinetic weapons. Hypersonic weapons, which travel at speeds exceeding Mach 5, present significant challenges to traditional air defense systems and require innovative countermeasure solutions. The development and deployment of these emerging technologies are driving market demand for advanced weapon systems capable of countering hypersonic threats and integrating DEW capabilities into existing air and missile defense architectures.

Leave a Comment