Aircraft Seating Size

Aircraft Seating Market Growth Projections and Opportunities

The Aircraft Seating Market is influenced by a multitude of dynamic factors that continuously shape its trajectory within the aviation industry. Primarily, the global demand for air travel stands as a significant driver propelling the growth of the aircraft seating sector. As the number of passengers opting for air transportation surges worldwide, airlines continually seek innovative seating solutions to accommodate growing passenger traffic across various cabin classes. This demand for efficient, comfortable, and versatile seating configurations drives manufacturers to develop cutting-edge designs that cater to diverse airline needs and evolving passenger preferences.

Technological advancements play a pivotal role in steering the dynamics of the aircraft seating market. Manufacturers relentlessly innovate to introduce advanced seating designs that prioritize passenger comfort, safety, and convenience. The integration of novel materials, ergonomic features, enhanced entertainment options, and space-efficient designs shapes the evolution of seating solutions, aligning with the industry's pursuit of passenger-centric innovation.

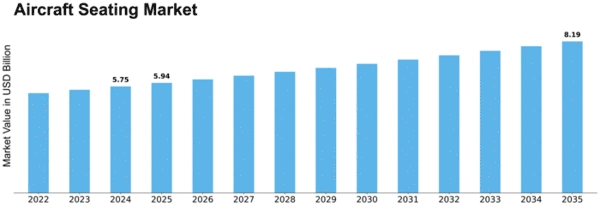

The consistent growth trajectory observed in the recent years within the Aircraft Seating Market continues to project significant expansion in the foreseeable future. Key drivers underpinning this growth surge have uplifted the market's pace globally, presenting numerous opportunities for accelerated growth on a worldwide scale. Market players are actively mitigating challenging and constraining factors to safeguard the growth momentum. Despite the challenges posed by the COVID-19 pandemic, the Aircraft Seating Market is poised to maintain a healthy Compound Annual Growth Rate (CAGR) throughout the assessment period.

Moreover, stringent safety regulations and industry standards significantly influence the aircraft seating dynamics. Aviation authorities impose rigorous safety measures and crashworthiness standards, mandating manufacturers to develop seating systems that comply with these regulations. The continuous focus on meeting safety protocols drives advancements in seating designs, ensuring passenger protection and crash survivability without compromising comfort or functionality.

The COVID-19 pandemic has introduced new dynamics into the aircraft seating market. Airlines are reevaluating seating configurations to adhere to social distancing guidelines and prioritize passenger health and safety. This has led to increased demand for adaptable seating solutions that offer flexibility in layouts, modular designs, and antimicrobial surfaces, reflecting a shift toward health-centric features and hygiene considerations in seating systems.

Economic factors, such as airline profitability, market competition, and operational efficiency, significantly impact the aircraft seating dynamics. Airlines' financial health and their focus on cost optimization influence decisions regarding seating upgrades, refurbishments, or new acquisitions. Market competition encourages manufacturers to offer competitive pricing, innovative solutions, and efficient manufacturing processes to secure contracts and gain market share.

Furthermore, customization and passenger-centric designs increasingly shape the dynamics of the aircraft seating market. Airlines seek seating solutions that cater to diverse passenger needs and preferences, from business class luxury to economy class efficiency. This trend drives manufacturers to offer customizable seating options, allowing airlines to create unique cabin layouts that prioritize passenger comfort and satisfaction.

Additionally, sustainability considerations have emerged as a significant dynamic in the aircraft seating market. Manufacturers are increasingly adopting eco-friendly materials and sustainable manufacturing practices to reduce environmental footprints. This trend aligns with airlines' and passengers' growing awareness of environmental responsibility, driving the development of greener seating solutions.

Leave a Comment