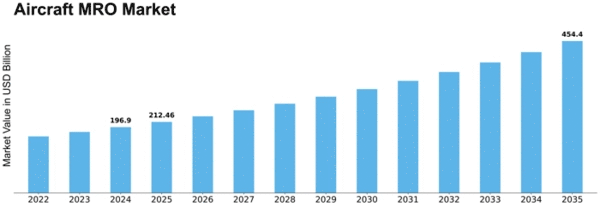

Aircraft Mro Size

Aircraft MRO Market Growth Projections and Opportunities

The Aircraft Maintenance, Repair, and Overhaul (MRO) market is a dynamic and essential thing in the aviation industry, playing a pivotal function in ensuring the safety and reliability of aircraft. Several market factors substantially have an impact on the Aircraft MRO market evaluation, reflecting the complex interaction of financial, technological, and regulatory forces. Economic elements are paramount in shaping the panorama of the Aircraft MRO market. The standard health of the global economic system, particularly the aviation area, immediately influences the demand for MRO services. During intervals of economic boom, airlines generally tend to make their fleets due to increased flight hours and, consequently, higher demand for maintenance and repair offerings. The Aircraft MRO Market, valued at USD 95 billion, is projected to develop at a CAGR of 6.05% from 2021 to 2030. The anticipated alternative of present industrial fleets with over 40,000 new planes in the subsequent decades is a key driving force. Technological improvements constitute any other critical component influencing the Aircraft MRO market. As planes emerge as more sophisticated and technologically advanced, MRO vendors must always spend money on education and infrastructure to keep up with evolving plane systems. Regulatory elements had a vast impact on the aircraft MRO market, with stringent safety and protection standards imposed by means of aviation government international. Compliance with these policies is non-negotiable, compelling MRO carriers to live abreast of evolving necessities. Changes in regulatory frameworks can affect the fee shape and operational tactics of MRO activities, necessitating adaptability and adherence to enterprise exceptional practices. Globalization performs a pivotal function in shaping the Aircraft MRO market overview. As airways expand their routes and operate in numerous geographical regions, MRO providers must establish a global presence to cater to the evolving desires of the industry. A mix of massive multinational MRO vendors and smaller regional gamers characterize the aggressive landscape. Environmental sustainability is an increasingly outstanding element within the Aircraft MRO market. Airlines and MRO providers face developing strain to adopt green practices, pushed via both regulatory requirements and a broader societal emphasis on sustainability. As a result, MRO vendors are exploring and imposing measures to lessen environmental impact, including the usage of sustainable substances, strength-green practices, and the development of green disposal methods for retired aircraft components.

Leave a Comment