Aircraft Leasing Size

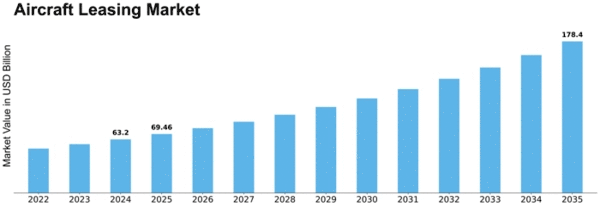

Aircraft Leasing Market Growth Projections and Opportunities

The expansion of the aircraft insurance market is anticipated to be fueled primarily by the increasing volume of air passenger traffic. This upward trajectory, however, may face constraints due to the high costs associated with aviation insurance claims. Conversely, a positive aspect emerges in the form of diminished barriers to market entry, offering lucrative prospects for participants in the global aircraft insurance market. Projections indicate a Compound Annual Growth Rate (CAGR) of 2.78% for the global aircraft insurance market within the forecast period of 2021 to 2027. In the year 2020, North America took the lead, commanding a substantial market share of 27.86%, closely followed by Europe and Asia Pacific with shares of 25.44% and 23.87%, respectively. The surge in air passenger traffic emerges as a central driver for the growth of the aircraft insurance market. As the aviation industry witnesses an increase in the number of individuals opting for air travel, the demand for insurance coverage for aircraft also experiences a corresponding rise. This trend is indicative of the intertwined relationship between the growth of air passenger traffic and the expansion of the aircraft insurance market. the burgeoning prospects of the aircraft insurance market encounter a hurdle in the form of costly insurance claims within the aviation sector. The intricate nature of the aviation industry, coupled with the high value of aircraft and potential liabilities, contributes to substantial insurance claims. This challenge poses a potential limitation to the unhindered growth of the global aircraft insurance market. On a more optimistic note, reduced barriers to entry in the market present an encouraging opportunity for players in the aircraft insurance domain. The lowering of barriers implies a more accessible entry point for new participants, fostering competition and potentially expanding the market. This positive aspect could lead to the emergence of innovative solutions, competitive pricing, and enhanced services within the aircraft insurance sector. the anticipated growth of the aircraft insurance market, fueled by the surge in air passenger traffic, is juxtaposed against the challenge of costly insurance claims. Nevertheless, the prospect of reduced market entry barriers introduces a promising avenue for industry players, suggesting a dynamic landscape for the global aircraft insurance market in the foreseeable future.

Leave a Comment