Aircraft Galley Equipment Size

Market Size Snapshot

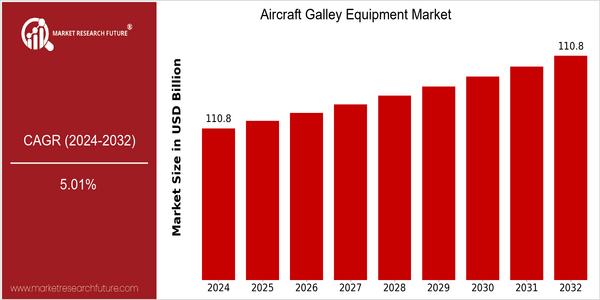

| Year | Value |

|---|---|

| 2024 | USD 110.8 Billion |

| 2032 | USD 110.8 Billion |

| CAGR (2024-2032) | 5.01 % |

Note – Market size depicts the revenue generated over the financial year

The Aircraft Galley Equipment Market is poised for steady growth, with a current market size of USD 110.8 billion in 2024, projected to maintain the same valuation by 2032. This stability, coupled with a compound annual growth rate (CAGR) of 5.01% over the forecast period, indicates a robust demand for innovative galley solutions in the aviation sector. The market's growth trajectory is influenced by several factors, including the increasing focus on passenger experience, advancements in food service technology, and the rising number of air travelers globally.

Technological trends such as the integration of smart kitchen equipment and energy-efficient appliances are driving the evolution of aircraft galleys, enhancing operational efficiency and sustainability. Key players in the market, including companies like Zodiac Aerospace, B/E Aerospace, and Diehl Aviation, are actively investing in research and development to introduce cutting-edge products and solutions. Strategic initiatives such as partnerships with airlines for customized galley designs and investments in sustainable materials are further propelling market growth, ensuring that the Aircraft Galley Equipment Market remains dynamic and responsive to the changing needs of the aviation industry.

Regional Market Size

Regional Deep Dive

The Aircraft Galley Equipment Market is experiencing dynamic growth across various regions, driven by increasing air travel demand, advancements in aviation technology, and a focus on passenger experience. Each region exhibits unique characteristics influenced by local regulations, economic conditions, and cultural preferences, shaping the market landscape. As airlines modernize their fleets and enhance onboard services, the demand for innovative galley equipment is expected to rise, presenting significant opportunities for manufacturers and suppliers in the sector.

Europe

- In Europe, the focus on passenger comfort and service quality is leading to innovations in galley equipment, such as modular designs that allow for flexible configurations. Companies like Zodiac Aerospace are at the forefront of these developments, providing customizable solutions to airlines.

- The European Union's stringent environmental regulations are pushing manufacturers to adopt sustainable practices, including the use of recyclable materials in galley equipment. This trend is likely to drive the market towards greener alternatives, aligning with the region's commitment to reducing carbon emissions.

Asia Pacific

- The Asia-Pacific region is experiencing rapid growth in air travel, particularly in emerging markets like India and China, which is driving demand for advanced galley equipment. Local manufacturers are increasingly partnering with global players to enhance their product offerings and meet the rising expectations of airlines.

- Innovations in technology, such as smart galley systems that integrate IoT capabilities, are gaining traction in this region. Companies like Thales are leading the charge, providing solutions that improve operational efficiency and enhance the passenger experience.

Latin America

- Latin America is witnessing a gradual recovery in air travel post-pandemic, leading to renewed investments in aircraft galley equipment. Airlines are focusing on upgrading their fleets to improve operational efficiency and passenger comfort, which is driving demand for modern galley solutions.

- Local regulations promoting safety and efficiency in aviation are encouraging airlines to adopt advanced galley equipment that complies with international standards. This regulatory environment is expected to foster innovation and competitiveness among regional manufacturers.

North America

- The North American market is witnessing a surge in demand for lightweight and energy-efficient galley equipment, driven by airlines' sustainability initiatives. Companies like Boeing and Airbus are collaborating with equipment manufacturers to develop eco-friendly solutions that reduce fuel consumption and waste.

- Regulatory changes, such as the FAA's updated safety standards for aircraft interiors, are prompting airlines to invest in modern galley equipment that meets these new requirements. This shift is expected to enhance safety and operational efficiency in the region.

Middle East And Africa

- In the Middle East, the expansion of major airlines like Emirates and Qatar Airways is significantly influencing the galley equipment market, as these carriers invest heavily in premium onboard services. This trend is driving demand for high-end galley solutions that cater to luxury travel experiences.

- The region's unique cultural factors, such as the emphasis on hospitality and service, are shaping the design and functionality of galley equipment. Manufacturers are adapting their products to meet these cultural expectations, which is expected to enhance customer satisfaction and loyalty.

Did You Know?

“Did you know that the average aircraft galley can hold up to 1,500 meals and is designed to accommodate various cooking and storage equipment to meet diverse passenger needs?” — International Air Transport Association (IATA)

Segmental Market Size

The Aircraft Galley Equipment segment plays a crucial role in enhancing in-flight service efficiency and passenger satisfaction, currently experiencing stable growth. Key drivers of demand include the increasing focus on passenger comfort and the need for airlines to optimize operational efficiency. Additionally, regulatory policies emphasizing food safety and hygiene standards further propel the adoption of advanced galley equipment.

Currently, the market is in a mature adoption stage, with leading companies like Zodiac Aerospace and B/E Aerospace implementing innovative solutions across major airlines in North America and Europe. Primary applications include food storage, preparation, and service, with examples such as modular galley systems that allow for flexible configurations based on aircraft type. Trends such as sustainability initiatives, including the shift towards eco-friendly materials and energy-efficient appliances, are catalyzing growth. Technologies like IoT-enabled equipment for real-time monitoring and smart galleys are shaping the segment's evolution, ensuring compliance with evolving industry standards and enhancing operational capabilities.

Future Outlook

The Aircraft Galley Equipment Market is poised for steady growth from 2024 to 2032, with a projected compound annual growth rate (CAGR) of 5.01%. This growth trajectory is underpinned by the increasing demand for enhanced passenger experiences and operational efficiency in the aviation sector. As airlines continue to prioritize customer satisfaction, the integration of advanced galley equipment that supports diverse meal options and improved service delivery will become paramount. By 2032, the market value is expected to reach approximately 110.8 million USD, reflecting a robust demand for innovative solutions that cater to evolving consumer preferences.

Key technological drivers, such as the adoption of lightweight materials and energy-efficient appliances, are expected to significantly influence the market landscape. Additionally, the push for sustainability in aviation will lead to a rise in the use of eco-friendly galley equipment, aligning with global environmental goals. Emerging trends, including the incorporation of smart technology for inventory management and food preparation, will further enhance operational efficiencies. As airlines adapt to these trends, the penetration of advanced galley equipment is anticipated to increase, positioning the market for sustained growth in the coming years.

Leave a Comment