- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

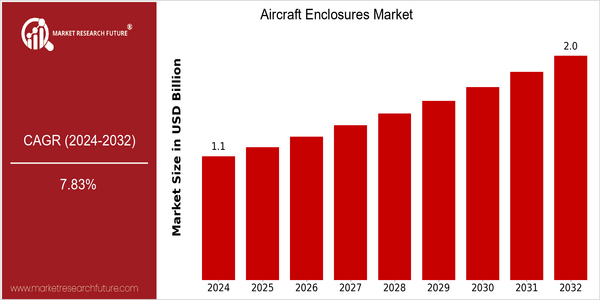

| Year | Value |

|---|---|

| 2024 | USD 1.06929 Billion |

| 2032 | USD 1.9547 Billion |

| CAGR (2024-2032) | 7.83 % |

Note – Market size depicts the revenue generated over the financial year

The Aircraft Enclosures Market is expected to grow at a CAGR of % between 2024 and 2032, from an estimated $1.069 billion in 2024 to $1.9,547,000 in 2032. This growth will be at a CAGR of % between 2024 and 2032. The growing demand for advanced aircraft systems, coupled with the increasing focus on aircraft performance and safety, is driving the market growth. In addition, the technological advancements, particularly in materials science and manufacturing processes, are expected to enable the development of more efficient and durable enclosures, further driving the market growth. The major players in the aircraft enclosures market, such as Honeywell Aerospace, Rockwell Collins, and Safran, are continuously investing in research and development to introduce new products. Strategic initiatives, such as joint ventures, collaborations, and acquisitions, are also gaining traction as companies are focusing on gaining a competitive edge over their rivals. In addition, the recent collaborations between the aerospace manufacturers and the technology companies aim to integrate smart technologies into the aircraft enclosures, which will enhance their functionality and efficiency. The growth in the aircraft enclosures market is expected to be driven by the technological advancements and strategic initiatives.

Regional Market Size

Regional Deep Dive

The Aircraft Enclosures Market is experiencing dynamic growth in various regions, owing to the growing demand for advanced aircraft technology and the rising need for aircraft maintenance solutions. Each region has its own unique characteristics, which are influenced by the economic and regulatory conditions of the region. North America is a technologically advanced region, with a strong focus on research and development. Europe, on the other hand, is a highly regulated region. The Asia-Pacific region is experiencing strong growth, owing to increasing air travel and investment in the aviation industry. The Middle East and Africa region is also gaining from strategic alliances and government initiatives to improve the aviation industry. Latin America, although a smaller region, is developing gradually through modernization and increasing foreign investment.

Europe

- European manufacturers are increasingly focusing on sustainable practices, with companies like Airbus leading initiatives to develop eco-friendly materials for aircraft enclosures, aligning with the EU's Green Deal objectives.

- The European Union's stringent regulations on emissions and noise pollution are driving innovation in aircraft design, leading to a demand for advanced enclosures that can support quieter and more efficient aircraft operations.

Asia Pacific

- The Asia-Pacific region is witnessing a surge in air travel, with countries like China and India investing heavily in their aviation sectors, leading to increased demand for aircraft enclosures that meet modern safety and performance standards.

- Government initiatives, such as India's 'Make in India' program, are encouraging local manufacturing of aircraft components, including enclosures, which is expected to boost the regional market significantly.

Latin America

- Latin America is gradually modernizing its aviation sector, with countries like Brazil and Mexico focusing on improving their aircraft maintenance capabilities, which is increasing the demand for high-quality enclosures.

- The region is also benefiting from foreign investments, particularly from U.S. and European companies looking to tap into the growing aviation market, leading to advancements in local manufacturing capabilities.

North America

- North America is dominated by the major aircraft builders, such as Boeing and Lockheed, which are investing heavily in the development of new materials and new technology for aircraft cabins, to increase their strength and performance.

- Recent regulatory changes by the Federal Aviation Administration (FAA) are pushing for stricter safety standards, prompting manufacturers to innovate and improve their enclosure designs to comply with new guidelines.

Middle East And Africa

- The Middle East is seeing significant investments in aviation infrastructure, with projects like the expansion of Dubai International Airport, which is driving demand for advanced aircraft enclosures to support new aircraft models.

- Strategic partnerships between local governments and international aerospace companies are fostering innovation in the region, with initiatives aimed at enhancing the capabilities of local manufacturers in producing high-quality enclosures.

Did You Know?

“Did you know that the weight of aircraft enclosures can significantly impact fuel efficiency? Lightweight materials used in enclosures can lead to a reduction in overall aircraft weight, improving fuel consumption by up to 5%.” — Aerospace Materials and Manufacturing Journal

Segmental Market Size

The market for aircraft enclosures is currently growing steadily, driven by the growing demand for advanced aircraft systems and the need for enhanced protection of sensitive equipment. Also driving this market is the growing emphasis on safety and reliability in the aviation industry, as well as regulatory policies requiring stricter safety standards. Furthermore, technological developments in materials and production methods are making it possible to produce more efficient and durable enclosures. The market is currently in a mature stage of development, with major players such as Airbus and Boeing implementing advanced enclosures in their aircraft designs. The main applications of enclosures are for avionics, surveillance and other critical systems, particularly in commercial and military aircraft. However, the market is also being driven by trends such as the trend towards sustainable development and the need for greener aviation solutions, which are encouraging manufacturers to look for lighter, more sustainable materials. In particular, newer, lighter materials such as composites and 3D printing are enabling manufacturers to produce enclosures with more efficient designs and lighter weights, in line with the increasingly stringent requirements of modern aviation.

Future Outlook

From 2024 to 2032, the market for aircraft covers will increase from approximately $1.07 billion to $1.95 billion, at a strong compound annual growth rate (CAGR) of 7.83%. It will be driven by the increasing demand for modern aircraft systems, such as UAVs and commercial aircraft, which require high-performance enclosures to protect sensitive electronic equipment from the environment. As the aviation industry continues to grow post-pandemic, the need for advanced and reliable enclosures will grow. The penetration rate of aircraft covers in various segments will increase. Also, the integration of lightweight materials and the development of advanced thermal management solutions will drive the market. Besides, the growing trend of sustainable aviation and the regulatory framework to reduce CO2 emissions will also influence the design and manufacturing of aircraft covers. In addition, the increasing application of smart and automation technology in the production process will increase the efficiency and performance of products, thus attracting new investments and promoting the competition in the market. The industry must therefore prepare for a new landscape characterized by innovation, collaboration, and sustainable development, and be ready to seize the opportunities ahead.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 0.981 Billion |

| Growth Rate | 7.83% (2024-2032) |

Aircraft Enclosures Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.