Top Industry Leaders in the Air Missile Defense Radar System Market

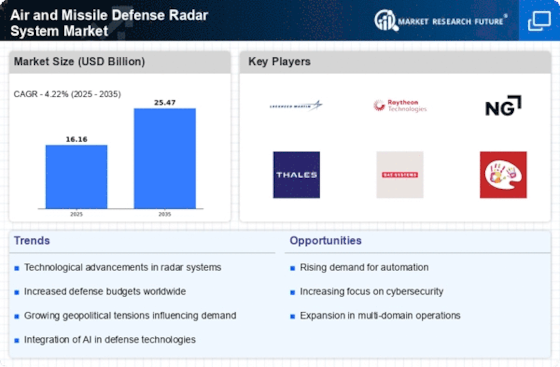

The Air and Missile Defense Radar System (AMDR) market has experienced significant growth and dynamism owing to evolving security threats globally. The competitive landscape within this market is characterized by a blend of established players, emerging companies, and technological advancements shaping the industry's trajectory.

The Air and missile defense radar system market Key Players Includes:

- Lockheed Martin Corporation,

- Northrop Grumman Corporation,

- Israel Aerospace Industries,

- Leonardo SpA,

- Raytheon Technologies Corporation

Strategies Adopted:

The competition in the AMDR market revolves around innovation, strategic collaborations, and mergers/acquisitions. Companies are investing heavily in R&D to develop advanced radar systems capable of detecting and countering evolving threats posed by modern air and missile technologies. Collaborations between defense contractors and government bodies are becoming more prevalent to accelerate technological advancements and secure lucrative contracts.

Factors for Market Share Analysis:

Several factors contribute to the analysis of market share within the AMDR sector. These include technological innovation, contract wins with government agencies, the ability to offer comprehensive solutions, geographic reach, cost-effectiveness, and the agility to adapt to evolving defense requirements swiftly.

New and Emerging Companies:

The landscape is witnessing the emergence of new players focusing on niche technological advancements. Companies like RADA Electronic Industries, Saab AB, and Israel Aerospace Industries are gaining traction with their innovative radar systems, positioning themselves as formidable competitors in specialized segments of the market.

Industry News and Trends:

Recent industry developments have been centered on the integration of Artificial Intelligence (AI), machine learning, and data analytics into radar systems, enhancing their capabilities to detect and counter sophisticated threats. Additionally, the market is witnessing a shift towards multifunctional radar systems, providing enhanced surveillance and targeting capabilities in a single platform.

Current Company Investment Trends:

Investment trends within the AMDR market depict a substantial focus on research and development. Companies are allocating significant budgets to develop next-generation radar systems with increased range, accuracy, and adaptability. Additionally, there's a growing emphasis on cybersecurity measures to safeguard these critical defense assets from cyber threats.

Overall Competitive Scenario:

The competitive scenario in the AMDR market is intense and dynamic. Established players are striving to maintain their market dominance through continuous innovation and strategic partnerships. Simultaneously, new entrants are disrupting the market by introducing novel technologies, challenging the status quo, and catering to specific niche demands.Recent Development:

In the global arena of air and missile defense, strategic movements and collaborations have been shaping the landscape, redefining defense capabilities and alliances. The events of 2022 have notably emphasized the importance of advanced defense systems and the pivotal role played by key players in this field.

The U.S. State Department's approval for the resupply of THAAD missile interceptors to the United Arab Emirates and Patriot missile interceptors to Saudi Arabia in August 2022 marked a significant step in reinforcing regional defense capabilities. This move highlighted the U.S.'s commitment to bolstering allied nations against potential missile threats, underlining the critical role of advanced defense systems in safeguarding both national and regional security interests.

In April 2022, Lockheed Martin, a prominent player in the defense industry, secured a substantial contract worth USD 4.7 billion. This contract was aimed at manufacturing radar systems and THAAD air defense systems—a significant milestone in providing crucial defense capabilities against short- and medium-range ballistic missiles. The contract not only reinforced the technological prowess of Lockheed Martin but also underscored the growing importance of advanced defense mechanisms in the face of evolving threats.

Simultaneously, the defense landscape witnessed another strategic move in March 2022 when Saudi Arabia forged a partnership with Lockheed Martin. This collaboration focused on defense deals aimed at manufacturing launchers and other essential equipment integral to the THAAD anti-missile defense system. This partnership signaled a deeper commitment by Saudi Arabia to fortify its defense capabilities and highlighted Lockheed Martin's role as a key enabler in providing cutting-edge defense solutions.

The series of events in 2022 showcased the pivotal role of advanced air and missile defense systems in shaping defense strategies globally. The collaborations between governments and industry leaders underscored the importance of technological advancements and strategic alliances in enhancing defense capabilities against evolving threats. These developments also highlighted the increasing reliance of nations on sophisticated defense mechanisms to ensure national security and regional stability in an increasingly complex geopolitical landscape.