Market Analysis

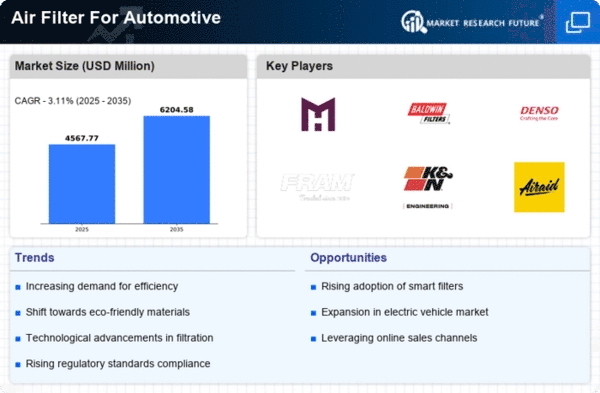

Air Filter for Automotive (Global, 2024)

Introduction

The air-filter industry is a vital part of the automobile industry, playing an important role in enhancing vehicle performance and ensuring the safety of its occupants. High-efficiency air filters are in great demand, thanks to tighter emissions standards and growing public awareness of the importance of clean air. The industry is huge, and there are many different types of filters to meet different needs. But the growing popularity of hybrid and electric vehicles is forcing air-filtration manufacturers to change their products. The development of new materials and manufacturing processes, and the rise of the aftermarket, are also changing the way the industry operates. The evolution of the automobile industry is a complicated and rapidly changing business. And for those wishing to stay abreast of developments, a thorough understanding of the latest trends and challenges in the air-filtration industry is essential.

PESTLE Analysis

- Political

- In 2024 the automobile industry is influenced by government regulations aimed at reducing exhaust emissions and improving air quality. For example, the European Union has set a goal of reducing the amount of greenhouse gases emitted by cars by at least 55% by 2030, which will directly affect the demand for efficient air filters. Also, the EPA has proposed stricter standards for particulate matter, which may lead to a higher adoption of advanced air filtration systems in cars, with an estimated 30% of new cars in the U.S. meeting these standards by 2025.

- Economic

- The automobile air filter market is also affected by macroeconomic indicators such as consumer spending and automobile sales. The average price of a new car in the United States in 2024 is expected to be about 48 thousand dollars, up 5% from the previous year. In order to protect their investment, consumers may pay more attention to the replacement of essential parts such as air filters. The employment of 9.5 million people in the world's automobile industry in 2024 also shows that the industry has a strong labor market.

- Social

- Among the most important developments in the automobile industry is the increasing public concern for the quality of the air and the health effects of the air. Surveys show that in 2024 72% of consumers are concerned about the air quality inside the car, and there is a growing demand for HEPA filters. This new demand for the manufacturer not only gives the opportunity to develop products that improve the air quality, but also to respond to the increasing demand for sustainable and eco-friendly automobile solutions. Furthermore, the trend towards electric cars will also lead to the development of specialized air filters adapted to these new technological developments.

- Technological

- For the evolution of the automobile air filters, technological progress plays a vital role. In 2024, the intelligent systems of the filters are becoming more and more widespread, and about one-fourth of the new cars have sensors to control the quality of the air and the performance of the filters. The maintenance of the filters is a function of this. This innovation improves the driving experience and makes it safer. And the materials sciences are bringing about lighter and more efficient filter media, which improve fuel consumption and meet the requirements of the authorities.

- Legal

- The automobile air-filtration market is increasingly influenced by legal regulations, in particular by compliance with the prevailing air-pollution regulations. In the year 2024, the U.S. Clean Air Act requires all automobile manufacturers to meet a specified emissions standard, which in turn requires the use of effective air filters. Fines of up to $ 37,500 per day of violation per car per day can be imposed, which will encourage automobile manufacturers to invest in high-quality air filters. Also, new regulations in several countries aiming at the prohibition of certain materials used in the production of conventional filters are driving the industry to adopt more sustainable production processes.

- Environmental

- Concern for the environment is the main concern in the air-filter market, especially in view of growing concern over climate change and pollution. It is estimated that in 2024 the share of automobiles in the total of greenhouse gas emissions in the United States will amount to about 29%. This demonstrates the importance of effective air-filtration systems for reducing the negative impact on the environment. In addition, the trend toward sustainable production is expected to lead to an increase in the use of biodegradable materials in air-filtration systems. It is estimated that by 2024 the percentage of biodegradable materials in new filters will amount to approximately 15%. This reflects the need to reduce the impact of automobile components on the environment.

Porter's Five Forces

- Threat of New Entrants

- The market for automobile air filters has a moderate degree of competition, owing to the need for technical knowledge and the requirements of legal standards. However, newcomers can still find opportunities if they focus on niches or innovation. The high cost of research and development may deter some entrants.

- Bargaining Power of Suppliers

- The bargaining power of suppliers in the market for car air filters is relatively low, because of the abundance of suppliers and raw materials. The manufacturer can obtain the raw material from different suppliers, thus reducing the dependence on a single supplier. This allows the manufacturer to bargain for better terms and prices.

- Bargaining Power of Buyers

- High - The buyers of the automobile air filter have a high bargaining power because of the large number of alternatives and the low costs of changing the brand. The consumers are becoming more and more knowledgeable and price-conscious, which makes the competition between manufacturers fiercer and the bargaining power of the buyer even higher.

- Threat of Substitutes

- The threat of substitutes in the air filter market is moderate. There are alternative filtration products, such as cabin filters and high-performance filters, but the specific role of air filters in maintaining the engine's efficiency and performance limits direct substitution. However, new technology could lead to the development of new substitutes that could be a threat.

- Competitive Rivalry

- Competition in the automobile air-cleaner market is very high, with many players vying for market share. Brands compete on quality, price and innovation, while newcomers seek to carve out a niche. The race for technological development and improved performance has intensified competition, making it essential for companies to distinguish themselves.

SWOT Analysis

Strengths

- High demand for air filters due to increasing vehicle production and sales.

- Technological advancements leading to more efficient and longer-lasting filters.

- Growing awareness of air quality and health benefits driving consumer preferences.

Weaknesses

- High competition leading to price wars and reduced profit margins.

- Dependence on the automotive industry, which can be cyclical.

- Limited consumer knowledge about the importance of regular air filter replacement.

Opportunities

- Expansion into emerging markets with rising automotive ownership.

- Development of eco-friendly and sustainable air filter options.

- Partnerships with automotive manufacturers for original equipment supply.

Threats

- Economic downturns affecting consumer spending on vehicle maintenance.

- Regulatory changes impacting manufacturing processes and materials.

- Increased competition from alternative air filtration technologies.

Summary

The automobile air filter market in 2024 is characterized by strong demand due to the increase in the number of vehicles and a growing concern for air quality. Competition is however expected to be fierce, and the market is dependent on the health of the automobile industry. Opportunities are mainly in emerging markets and in the development of sustainable products. Threats are economic fluctuations and changes in legislation. The companies should take advantage of their strengths and seek new alliances to successfully compete in the market.

Leave a Comment