Air Ambulance Services Size

Air Ambulance Services Market Growth Projections and Opportunities

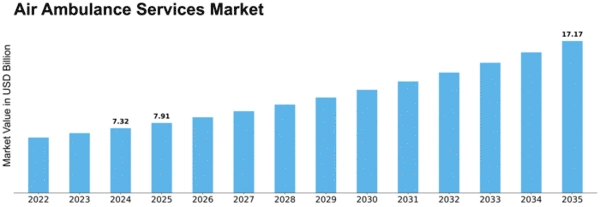

The global air ambulance services market is experiencing robust growth, driven by factors such as increasing per capita healthcare expenditure and a rise in the number of advanced hospitals and emergency room (ER) visits. Projections indicate that the market is set to register a Compound Annual Growth Rate (CAGR) of 2.95% during the forecast period from 2019 to 2024. In 2018, North America dominated the market, holding a commanding 65.46% share, followed by Europe at 21.27%, and Asia-Pacific at 11.28%. The market dynamics are shaped by several key segments, including transport vehicle, aircraft type, service model, and mission profile. In terms of transport vehicle, the ground segment took the lead in 2018, capturing a significant share of 82.22% in the global air ambulance services market. This dominance highlights the critical role ground transport plays in facilitating timely and efficient medical assistance. Examining the aircraft type, the rotary-wing segment emerged as the frontrunner in 2018, securing a substantial market share of 63.26%. This underscores the prominence of rotary-wing aircraft, such as helicopters, in air ambulance services. Their agility and ability to access remote or challenging terrains make them vital assets in emergency medical transport. Delving into the service model segment, the hospital-based model commanded the largest market share in 2018, accounting for 56.35%. This indicates the prevalence of hospital-affiliated air ambulance services, reflecting the synergy between airborne medical assistance and hospital infrastructure. Considering the mission profile, the inter-facility transport segment emerged as the dominant force in 2018, claiming a significant market share of 63.66%. Inter-facility transport involves the transfer of patients between medical facilities, showcasing the pivotal role air ambulances play in seamlessly connecting healthcare institutions for specialized care and treatment. The rise of the global air ambulance services market is intricately linked to the evolving landscape of healthcare delivery, with an increasing focus on swift and efficient emergency medical response. The surge in per capita healthcare expenditure signals a growing awareness of the importance of timely and specialized medical assistance, propelling the demand for air ambulance services. North America's leading position in the market can be attributed to its well-established healthcare infrastructure, technological advancements, and a robust network of air ambulance services. As the demand for these services continues to grow globally, regions like Asia-Pacific are expected to witness significant expansion, driven by increasing healthcare investments and a burgeoning population with higher healthcare expectations. The global air ambulance services market is on a trajectory of sustained growth, driven by factors such as increased healthcare spending and the need for rapid emergency medical response. The dominance of North America, coupled with the prominence of ground transport, rotary-wing aircraft, hospital-based service models, and inter-facility transport missions, showcases the diverse and dynamic nature of this essential sector. As healthcare needs evolve, the air ambulance services market is poised to play a pivotal role in ensuring prompt and effective emergency medical care on a global scale.

Leave a Comment