Market Trends

Key Emerging Trends in the AI Audio Video SoC Market

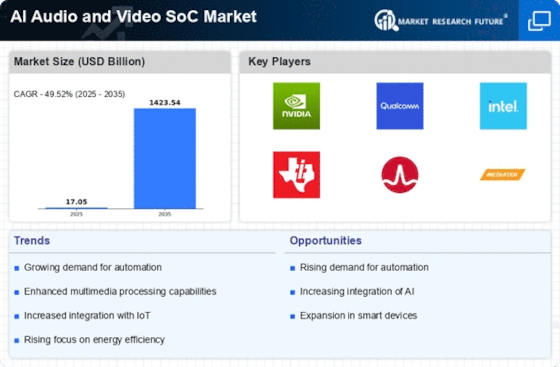

The AI Audio Video System on Chip (SoC) market is witnessing a multitude of trends that are reshaping the industry and driving technological advancements. One prominent trend is the increasing integration of AI-powered voice assistants in smart devices. As voice recognition technology becomes more sophisticated, AI Audio Video SoCs are being designed to efficiently process voice commands, enabling seamless interaction with devices such as smart speakers, smartphones, and smart TVs. This trend aligns with the growing consumer preference for hands-free and voice-activated controls, marking a significant shift in the way users interact with their devices.

Another notable trend is the rise of AI-enhanced video processing capabilities in SoCs. As consumers demand higher resolution and richer visual experiences, AI Audio Video SoCs are incorporating advanced video processing algorithms. These algorithms optimize video quality, enhance image recognition, and enable features like real-time object tracking and scene recognition. This trend is particularly evident in applications such as video streaming, gaming, and augmented reality, where superior video processing capabilities contribute to a more immersive user experience.

The increasing prevalence of edge AI is a key trend influencing the AI Audio Video SoC market. Edge AI involves processing data locally on the device, reducing the need for constant connectivity to cloud servers. AI Audio Video SoCs optimized for edge computing are gaining popularity in applications like smart cameras and IoT devices, where real-time processing is essential. This trend reflects a shift towards more decentralized and efficient processing, addressing concerns related to latency, privacy, and bandwidth usage.

Moreover, there is a growing emphasis on energy efficiency and sustainability in the AI Audio Video SoC market. As environmental consciousness rises, manufacturers are developing SoCs with lower power consumption. Energy-efficient designs not only contribute to longer battery life in portable devices but also align with global initiatives to reduce electronic waste and promote sustainable technology. This trend is pushing the industry towards more eco-friendly solutions, creating a positive impact on both consumers and the environment.

The emergence of 8K resolution in displays is influencing the AI Audio Video SoC market, necessitating SoCs with enhanced processing power to support the demanding requirements of ultra-high-definition content. As 8K displays become more prevalent, the market trends towards SoCs that can efficiently handle the increased data bandwidth and processing demands associated with higher resolutions. This trend caters to the growing appetite for high-quality visuals and supports the development of advanced display technologies across various devices.

Furthermore, the market is witnessing a trend towards the integration of AI-powered security features in SoCs. With an increasing focus on privacy and data security, AI Audio Video SoCs are being equipped with facial recognition, gesture control, and other biometric authentication capabilities. This trend is particularly relevant in devices like smart doorbells, surveillance cameras, and smartphones, where enhanced security features contribute to a safer and more secure user experience.

The evolution of AI Audio Video SoCs in the automotive industry is a noteworthy trend, with the integration of advanced driver-assistance systems (ADAS) and in-car entertainment systems. SoCs designed for automotive applications incorporate AI algorithms for image recognition, object detection, and voice commands, contributing to enhanced safety and entertainment features. This trend aligns with the ongoing developments in autonomous driving technology and the increasing demand for smart and connected vehicles.

Leave a Comment