Rising Global Food Demand

The Agriculture Reinsurance Market is also being propelled by the rising global food demand. As the world population continues to grow, the pressure on agricultural production intensifies. This demand surge necessitates increased investment in agricultural practices and infrastructure, which inherently carries risks. Reinsurance plays a crucial role in supporting farmers and agribusinesses by providing financial protection against potential losses. According to recent estimates, food demand is expected to increase by 70% by 2050, which will likely drive the need for comprehensive risk management solutions. Consequently, reinsurance companies are adapting their strategies to cater to this growing market, ensuring that they can meet the evolving needs of the agricultural sector while maintaining profitability.

Increasing Weather Variability

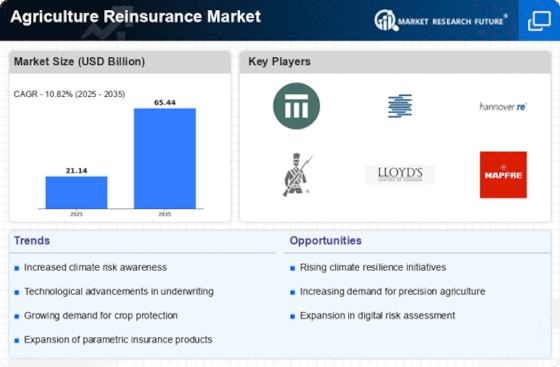

The Agriculture Reinsurance Market is experiencing heightened demand due to increasing weather variability. This variability, characterized by unpredictable rainfall patterns, extreme temperatures, and natural disasters, poses significant risks to agricultural production. As farmers face these challenges, the need for reinsurance solutions becomes more pronounced. In recent years, the industry has seen a surge in claims related to weather events, prompting insurers to innovate their offerings. For instance, the market is projected to grow at a compound annual growth rate of approximately 5.2% over the next five years, driven by the necessity for risk management solutions that can mitigate the financial impacts of adverse weather conditions. This trend indicates a robust opportunity for reinsurance providers to develop tailored products that address the specific needs of farmers and agricultural businesses.

Government Initiatives and Subsidies

Government initiatives and subsidies are vital drivers of the Agriculture Reinsurance Market. Many governments recognize the importance of a stable agricultural sector and are implementing policies to support farmers through financial assistance and risk management programs. These initiatives often include subsidized insurance premiums, which make reinsurance more accessible to smallholder farmers. Such support not only encourages farmers to adopt insurance but also enhances the overall resilience of the agricultural sector. In several regions, government-backed reinsurance schemes have been established to mitigate risks associated with climate change and market fluctuations. This proactive approach by governments is likely to foster a more robust reinsurance market, as it creates a safety net for farmers and encourages investment in agricultural production.

Technological Advancements in Agriculture

Technological advancements in agriculture are significantly influencing the Agriculture Reinsurance Market. Innovations such as precision farming, satellite imagery, and data analytics are enabling farmers to optimize their operations and reduce risks. These technologies allow for better monitoring of crop health and yield predictions, which in turn informs reinsurance underwriting processes. As a result, insurers are increasingly relying on data-driven insights to assess risks and set premiums. The integration of technology is expected to enhance the efficiency of claims processing and risk assessment, potentially leading to a more competitive market landscape. Furthermore, the adoption of these technologies is likely to increase the overall resilience of the agricultural sector, thereby fostering a more stable environment for reinsurance providers.

Emerging Markets and Investment Opportunities

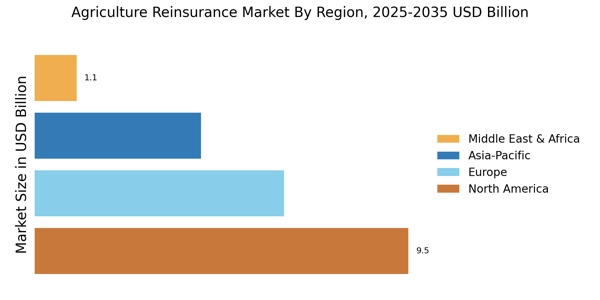

Emerging markets present substantial opportunities for the Agriculture Reinsurance Market. As developing countries enhance their agricultural sectors, the demand for reinsurance solutions is expected to rise. These markets often face unique challenges, including limited access to traditional insurance products and heightened vulnerability to climate risks. Reinsurers are increasingly recognizing the potential for growth in these regions and are tailoring their offerings to meet local needs. Investment in agricultural infrastructure and technology in these markets is likely to drive demand for reinsurance, as stakeholders seek to protect their investments. Furthermore, partnerships between local insurers and global reinsurers are becoming more common, facilitating knowledge transfer and capacity building. This trend indicates a promising future for the Agriculture Reinsurance Market, as it expands into new territories and adapts to diverse agricultural landscapes.