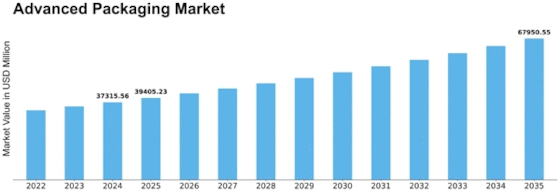

Advanced Packaging Size

Advanced Packaging Market Growth Projections and Opportunities

New packaging technologies, like 3D IC packaging and System-in-Package (SiP) solutions, are needed because of the fast growth of technology in the semiconductor and electronics industries. People want small, high-performance devices, which drives the need for new packaging technologies. The development of consumer electronics, like smartphones, wearable tech, and smart devices, also has a big impact on the need for new packaging. More and more IoT devices and apps need advanced packaging solutions that can fit complex functions into small spaces. As the IoT ecosystem grows, so does the need for packaging technologies that can handle a wide range of sensors and parts. A big part of sophisticated packaging is making electronic parts and systems smaller. Smaller form factors not only adapt to consumer tastes, but they also improve performance, energy efficiency, and product innovation as a whole. It is important to think about better power distribution, better thermal management, and more data-centric applications as the demand for advanced packaging in server and high-performance computing applications grows. Concerns about the long-term health of the environment have an effect on the global market for advanced packaging. Companies are looking into eco-friendly materials and methods, and recycling and lowering the environmental impact of packaging solutions are becoming more important. Advances in packaging materials, including organic substrates, advanced polymers, and composite materials, contribute to the development of more robust and reliable packaging solutions. Material innovations address challenges such as thermal management, signal integrity, and overall reliability. Supply chain disruptions in the advanced packaging business might occur as a result of geopolitical conflicts, natural disasters, or global events such as the COVID-19 pandemic. These disruptions might impair raw material supply and production schedules. Following industry rules and standards is important for people who work in the advanced packaging market, especially in the semiconductor and electronics industries. Following quality standards and rules is necessary for getting into the market and staying competitive in the long term.

Leave a Comment