Top Industry Leaders in the Advanced Energy Storage Systems Market

*Disclaimer: List of key companies in no particular order

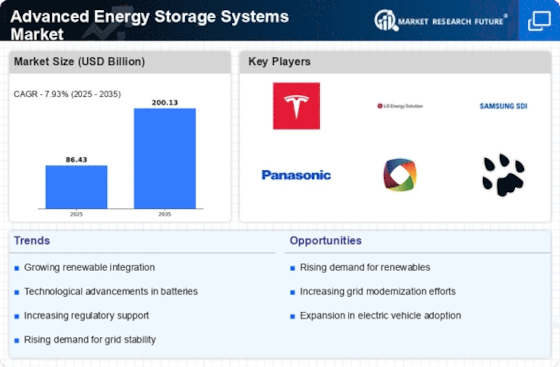

Exploring the Dynamic Terrain of the Market for Advanced Energy Storage Systems

In the realm of advanced energy storage systems, the global landscape is currently undergoing a profound metamorphosis. This transformation is steered by the surging expansion of renewable energy sources, an escalating demand for electricity, and governmental initiatives advocating sustainable energy solutions. Within this ever-shifting panorama, an array of diverse contenders engages in fierce competition for market dominance, each deploying distinct strategies and seizing emerging trends.

Strategic Moves by Key Players:

Established giants such as LG Chem, ABB, Nippon, and Toshiba leverage their extensive expertise, global outreach, and robust research and development capabilities to sustain a formidable market presence. Their focus lies in expanding production scale, optimizing costs, and diversifying product portfolios to cater to a broad spectrum of applications. Moreover, they engage in collaborations with key stakeholders in the energy sector to craft tailor-made solutions and secure enduring partnerships.

Challenges from Up-and-Coming Competitors:

Challengers, emerging with vigor, are disrupting the status quo by presenting innovative technologies, cost-effective solutions, and an agile, customer-centric approach. Entities like Fluence Energy, Sonnen GmbH, and Stem, Inc. concentrate on niche markets, cultivate smart grid solutions, and harness digital technologies to elevate system performance and streamline energy management.

Even traditional energy behemoths are entering the arena, recognizing the transformative potential of advanced energy storage in reshaping the energy landscape. Players such as Siemens, Schneider Electric, and GE leverage their existing infrastructure and expertise to provide comprehensive energy storage solutions, spanning power conversion systems, grid management software, and financing alternatives.

Tech-focused startups like Form Energy, Quidnet Energy, and Antora Energy are at the vanguard of innovation, pioneering novel battery chemistries, next-gen energy storage technologies, and AI-infused optimization solutions. These ventures often form partnerships with established players or secure venture capital to expedite their growth and introduce groundbreaking technologies to the market.

Determinants of Market Share Analysis:

Several factors wield influence over a company's market share in the advanced energy storage systems sector, including:

-

Technology Portfolio: Companies boasting a diverse array of technologies spanning grid storage, microgrids, and electric vehicles gain a competitive edge.

-

Cost Competitiveness: Offering economical and scalable solutions proves pivotal in attracting customers and achieving widespread market penetration.

-

Partnerships and Collaborations: Strategic alliances with utilities, renewable energy developers, and technology providers unlock new market vistas and hasten growth.

-

Brand Recognition and Reputation: A robust brand built on reliability, performance, and customer service attracts investments and facilitates market expansion.

-

Innovation and R&D: Continuous investments in research and development to birth next-gen technologies and refine existing solutions are critical for long-term success.

-

Government Policies and Incentives: Favorable governmental policies and incentives can significantly stimulate demand for advanced energy storage systems, offering avenues for market expansion.

Unfolding Trends in the Market:

Several trends are currently shaping the future of the advanced energy storage systems market:

-

Decentralization of Energy Storage: The trend towards distributed generation and microgrids propels the demand for smaller, modular storage solutions tailored for residential and commercial applications.

-

Integration of AI and Machine Learning: Advanced analytics and machine learning algorithms optimize energy management, elevate system performance, and enable predictive maintenance.

-

Second-Life Applications for Batteries: Repurposing used electric vehicle batteries for grid storage or microgrid applications is gaining traction, promoting sustainability and cost-effectiveness.

-

Rise of Hydrogen Energy Storage: Hydrogen emerges as a promising long-term energy storage solution, boasting high energy density and flexibility.

-

Digitalization and Cloud-Based Platforms: Cloud-based platforms facilitate remote monitoring, control, and optimization of energy storage systems, enhancing efficiency and reducing operational costs.

The Competitive Tapestry:

The market is characterized by intense competition, with entities striving to distinguish themselves through innovation, cost-effectiveness, and strategic partnerships.

Looking ahead, the market is poised to witness further consolidation, with mergers and acquisitions unfolding between established players and tech startups. Collaboration and partnerships between diverse stakeholders in the energy ecosystem will become increasingly vital for driving innovation and accelerating market growth. The overall competitive scenario will persist in its dynamic nature, demanding companies to be agile, adaptable, and consistently innovative to secure their standing in this rapidly evolving market.

Industry Dynamics and Recent Updates:

AES Corporation (US): Date: November 30, 2023: Development: Announced a collaboration with Mitsubishi Heavy Industries (MHI) to pioneer the world's largest lithium-ion battery storage system in California. The 400-megawatt/1,600-megawatt-hour project aims to store energy from renewable sources and bolster grid stability.

Tesla, Inc. (US): Date: December 12, 2023: Development: Successfully delivered its inaugural Megapack, a large-scale energy storage system, to Australia. The Megapack is designed to store energy from a 150-megawatt solar farm and contribute to grid stabilization.

GENERAL ELECTRIC (US): Date: October 25, 2023: Development: Unveiled the GridLMV battery storage system, tailored for high-voltage applications. Capable of storing up to 4 megawatt-hours of energy, the GridLMV is well-suited for utility and industrial use.

ABB (Switzerland): Date: November 17, 2023: Development: Secured a contract to supply a 180-megawatt energy storage system to a wind farm in India. The system aims to integrate renewable energy into the grid and enhance grid stability.