Top Industry Leaders in the Additive Manufacturing Machine Market

*Disclaimer: List of key companies in no particular order

Top listed global companies in the Additive Manufacturing Machine industry are:

DMG MORI Co., Ltd.

Mazak Corporation

Matsuura Machinery Corporation

Stratasys Ltd

Voxeljet AG

Optomec

SLM SOLUTIONS GROUP AG

Eplus3D

Okuma America Corporation

Fabrisonic

Bridging the Gap by Exploring the Competitive Landscape of the Additive Manufacturing Machine Top Players

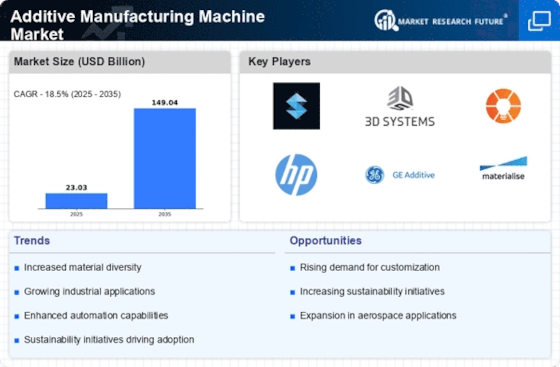

The global additive manufacturing (AM) machine market is experiencing a dynamic shift, driven by rapid technological advancements, diverse application areas, and an influx of new players. Understanding the competitive landscape is crucial for established manufacturers and potential entrants alike. This analysis delves into key player strategies, market share factors, emerging trends, and the overall competitive scenario.

Key Player Strategies:

- Market Leaders: Established players like SLM Solutions, EOS GmbH, Renishaw, and GE Additive dominate the market with robust portfolios spanning metal and polymer technologies. They focus on continuous technology upgrades, expanding material compatibility, and building strong customer relationships through service and software offerings.

- Strategic Acquisitions: Mergers and acquisitions are shaping the landscape, with established players acquiring promising startups to diversify their technology offerings and access new markets. For instance, Stratasys' acquisition of MakerBot strengthened its desktop 3D printer segment.

- Regional Expansion: Players are actively expanding their geographical reach, establishing production facilities and distribution networks in emerging markets like China and India. This allows them to cater to local demand and optimize supply chains.

- Vertical Diversification: Beyond traditional strongholds like aerospace and automotive, companies are venturing into healthcare, consumer goods, and other verticals. This diversification mitigates risk and unlocks new growth opportunities.

Factors for Market Share Analysis:

- Technology Portfolio: Offering a variety of AM technologies like powder bed fusion, vat polymerization, and directed energy deposition caters to diverse customer needs and applications.

- Material Compatibility: The ability to process a wide range of materials, including metals, polymers, and composites, expands addressable markets and attracts specialized customers.

- Machine Performance: Factors like build speed, accuracy, surface finish, and machine uptime directly impact production efficiency and cost-effectiveness for customers.

- Software Integration: Offering robust software for design optimization, build preparation, and machine control streamlines workflows and enhances user experience.

- Post-Processing Solutions: Providing integrated or compatible post-processing solutions like machining, polishing, and heat treatment adds value for customers seeking complete manufacturing workflows.

Emerging Trends:

- Metal AM for Production: Traditional players and startups are pushing metal AM beyond prototyping and into series production for aerospace, automotive, and other industries. This requires cost reduction, quality control advancements, and material certification standardization.

- Multi-material Printing: Advancements in multi-material printers enable creation of objects with different functionalities and properties within a single build. This opens doors for innovative applications in various sectors.

- Cloud-based AM: Offering cloud-based AM platforms for design, file storage, and remote machine control allows for decentralized production and flexible scalability. This is particularly attractive for small and medium enterprises.

- Sustainability Focus: Development of recyclable filaments, energy-efficient printing processes, and closed-loop material systems align with the growing demand for sustainable manufacturing practices.

Overall Competitive Scenario:

The competitive landscape of the AM machine market is characterized by dynamic innovation, strategic collaborations, and intense competition. Established players leverage their experience and resources to maintain dominance, while startups disrupt the market with niche technologies and flexible business models. The focus is shifting towards production-grade solutions, material diversification, and integrated workflows. New entrants need to offer unique value propositions, cater to specific verticals, and adopt agile strategies to secure a foothold in this rapidly evolving market.

Understanding the competitive landscape of the AM machine market is essential for navigating the complex dynamics and identifying potential opportunities. By analyzing key player strategies, market share factors, and emerging trends, businesses can make informed decisions and develop successful strategies to thrive in this ever-evolving landscape.

Latest Company Updates:

DMG MORI Co., Ltd.

- Date: October 26, 2023

- News: DMG MORI announces its entry into the metal additive manufacturing market with the launch of the AM SprintLine metal powder bed fusion (PBF) system. (Source: DMG MORI press release)

Mazak Corporation

- Date: December 7, 2023

- News: Mazak showcases its latest advancements in laser metal deposition (LMD) technology at Formnext 2023, including the Varia Hybrid 5X for large-scale metal additive manufacturing. (Source: Mazak website)

Matsuura Machinery Corporation

- Date: November 15, 2023

- News: Matsuura launches the LUMEX L series of metal PBF machines, offering high precision and build volume for aerospace and medical applications. (Source: Matsuura press release)

Stratasys Ltd

- Date: January 10, 2024

- News: Stratasys introduces the F900 FDM printer, featuring high-temperature capabilities and compatibility with advanced materials for industrial applications. (Source: Stratasys website)

Voxeljet AG

- Date: December 12, 2023

- News: Voxeljet partners with Siemens Materials Solutions to integrate additive manufacturing into industrial production workflows. (Source: Voxeljet press release)