Market Analysis

In-depth Analysis of Active Oxygens Market Industry Landscape

The market dynamics of the Active Oxygens Market have been undergoing notable changes in response to various factors shaping the demand and supply of active oxygen-based products. Active oxygens, including oxygen-based bleaching agents like hydrogen peroxide, sodium percarbonate, and sodium perborate, play a crucial role in industries such as healthcare, textiles, and water treatment. One significant driver of market dynamics is the increasing awareness and emphasis on cleanliness and hygiene across diverse sectors.

In the healthcare industry, the demand for active oxygens is witnessing a steady rise due to their disinfectant and sterilizing properties. Hospitals, clinics, and other healthcare facilities are increasingly adopting active oxygen-based products to ensure effective sanitation and infection control. The ongoing global focus on health and hygiene, particularly in the wake of health crises, has contributed to the surge in demand for active oxygens as a reliable and efficient means of maintaining a clean and sterile environment.

The textile industry is another major contributor to the market dynamics of active oxygens. These compounds are widely used as bleach and stain removers in the textile manufacturing process. The demand for vibrant and spotless textiles, coupled with the need for environmentally friendly bleaching agents, has driven the adoption of active oxygens in this sector. Market players are responding to this demand by developing and offering innovative active oxygen-based products that meet both performance and sustainability criteria.

Water treatment is yet another sector influencing the market dynamics of active oxygens. The need for clean and safe water is a global concern, and active oxygens play a crucial role in water treatment processes. From disinfecting drinking water to treating wastewater, these compounds are instrumental in ensuring the removal of contaminants and harmful microorganisms. As water scarcity and pollution become increasingly prevalent issues, the demand for effective water treatment solutions is expected to fuel the growth of the active oxygens market.

Regulatory factors also contribute significantly to the market dynamics of active oxygens. Governments worldwide are implementing stringent regulations to control and monitor the use of chemicals in various industries. The active oxygens market is no exception, with regulatory bodies setting standards for the production, handling, and disposal of these compounds. Compliance with these regulations is becoming a key consideration for market players, influencing their strategies and operations.

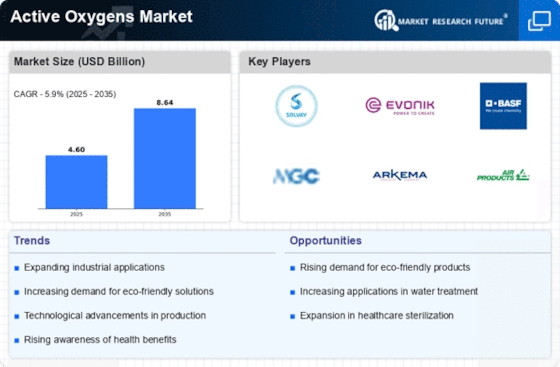

Global economic conditions and technological advancements further shape the market dynamics of active oxygens. Economic growth, industrialization, and technological innovations impact the production processes and applications of active oxygens. Additionally, ongoing research and development efforts contribute to the introduction of new and improved active oxygen-based products, fostering innovation within the market.

Competitive forces within the industry play a pivotal role in shaping market dynamics. As the demand for active oxygens continues to rise, companies are focusing on differentiation and diversification of their product portfolios. This includes developing specialized formulations catering to specific industries and applications. Market players are also exploring strategic collaborations and partnerships to expand their market reach and enhance their competitive position.

Moreover, environmental sustainability is emerging as a key trend in the market dynamics of active oxygens. With growing awareness of environmental issues, consumers and businesses alike are increasingly inclined towards eco-friendly and sustainable products. Market players are responding by investing in research and development to create active oxygen formulations that are not only effective but also environmentally responsible.

Leave a Comment