Market Analysis

In-depth Analysis of Active Network Management Market Industry Landscape

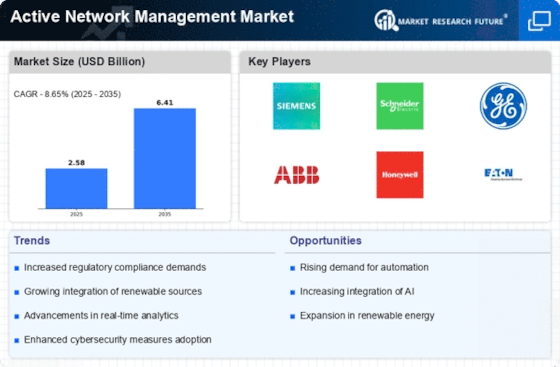

Active Network Management (ANM) market has undergone substantial growth and transformation, driven by the increasing complexity of modern energy grids and the need for efficient management of power distribution. ANM represents a dynamic approach to controlling and optimizing the flow of electricity in real-time, leveraging advanced monitoring and automation technologies. The market dynamics of ANM are influenced by factors such as the integration of renewable energy sources, the demand for grid reliability, regulatory initiatives, and technological innovations.

One of the primary drivers shaping the market dynamics of ANM is the integration of renewable energy sources into the power grid. The rise of solar and wind energy has introduced new challenges related to the intermittent nature of these sources. ANM solutions enable utilities to dynamically manage and balance the electricity grid, ensuring a smooth integration of renewable energy while maintaining grid stability. The growing emphasis on sustainability and the reduction of carbon emissions further drives the adoption of ANM technologies.

The competitive landscape of the ANM market is characterized by a mix of established energy management solution providers and newer entrants specializing in advanced grid control technologies. Traditional players bring their expertise in energy infrastructure, while newer entrants often focus on software-driven solutions, analytics, and the use of artificial intelligence for real-time decision-making. This competition stimulates innovation and encourages the development of ANM solutions that can adapt to the evolving needs of utilities and grid operators.

Government policies and regulatory frameworks play a pivotal role in shaping the market dynamics of ANM. Many governments around the world are implementing regulations and incentives to promote the integration of renewable energy and enhance grid efficiency. ANM solutions help utilities comply with these regulations by providing the necessary tools for monitoring, controlling, and optimizing energy flows in a way that maximizes the use of renewable resources.

Technological advancements in sensors, communication networks, and analytics significantly influence the market dynamics of ANM. The deployment of smart grid technologies and the Internet of Things (IoT) enable utilities to gather real-time data from various points in the grid. ANM solutions leverage this data to make informed decisions on energy routing, load balancing, and fault detection, contributing to the overall reliability and resilience of the power infrastructure.

Interoperability and standardization efforts are essential components of the ANM market dynamics. Standardized communication protocols and interfaces allow different components of ANM systems to seamlessly work together, ensuring compatibility and ease of integration. Interoperability is crucial for utilities that may have diverse equipment from various vendors in their power infrastructure.

Strategic partnerships and collaborations between ANM solution providers, utilities, and technology firms contribute to the evolving dynamics of the market. These partnerships aim to create end-to-end solutions that address the specific needs of utilities, facilitate the deployment of ANM technologies, and accelerate the transition to more intelligent and adaptive power grids.

Leave a Comment