A2 Milk Size

A2 Milk Market Growth Projections and Opportunities

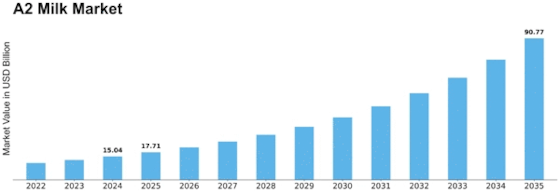

The global A2 milk market has experienced a sustained and growing demand in recent years, with projections indicating a robust expansion to reach a market value of USD 13,970.0 Million by 2025. This growth is anticipated to occur at a Compound Annual Growth Rate (CAGR) of 14.6%. A2 milk is distinct from conventional milk in that it contains the A2 protein Beta-Casein, as opposed to the A1 protein commonly found in regular milk. The market's ascent is primarily propelled by the advantages offered by A2 milk, such as its ease of digestibility. Additionally, the increasing applications of A2 milk in infant formulations contribute significantly to the market's upward trajectory. However, the higher pricing of A2 milk represents a potential constraint on the market's growth.

One of the key factors driving the growth of the A2 milk market is its perceived health benefits, particularly in terms of digestive comfort. A2 milk is believed to be more easily digestible compared to conventional A1 milk, as it lacks the A1 protein that has been associated with certain digestive discomforts. Consumers, particularly those with lactose intolerance or sensitivity to A1 protein, are increasingly opting for A2 milk as a more comfortable and digestible alternative.

Furthermore, A2 milk has gained popularity among parents and caregivers for its potential benefits in infant formulations. As infants have developing digestive systems, A2 milk is considered a gentle and easily digestible option. Manufacturers have recognized this trend and are incorporating A2 milk into various infant nutrition products, contributing to the expanding applications of A2 milk in the market.

However, despite the positive aspects of A2 milk, the market faces challenges due to its higher price compared to conventional milk. The production and processing of A2 milk involve specialized methods and breeding practices to ensure the A2 protein composition, which can lead to increased costs. As a result, the higher price point may limit its widespread adoption, particularly in price-sensitive markets.

In addition to its use in liquid form, A2 milk is finding its way into various dairy products, including yogurt, cheese, and other processed items. The diversification of A2 milk into different dairy segments broadens its appeal to consumers seeking A2 protein benefits across a range of products.

Geographically, the A2 milk market has witnessed significant growth in regions such as North America, Europe, Asia-Pacific, and beyond. The adoption of A2 milk is influenced by factors such as consumer awareness, dietary preferences, and the availability of A2 milk products in the market. In developed regions like North America and Europe, where health-conscious consumer trends prevail, the demand for A2 milk is notable.

Asia-Pacific, with its large population and increasing consumer awareness, is emerging as a significant market for A2 milk. Countries like China and India are witnessing a surge in demand for A2 milk, driven by a growing middle class, rising disposable income, and a heightened interest in health and wellness. Market players are strategically expanding their presence in these regions to capitalize on the untapped potential of the A2 milk market.

As the market continues to evolve, innovation in product offerings, marketing strategies, and distribution channels will play a crucial role in sustaining the growth of the A2 milk market. Product positioning that emphasizes health benefits, partnerships with retailers and health-focused outlets, and ongoing consumer education campaigns will contribute to expanding the consumer base for A2 milk.

Leave a Comment