- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

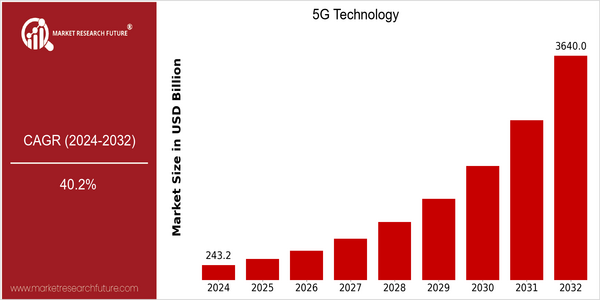

| Year | Value |

|---|---|

| 2024 | USD 243.2 Billion |

| 2032 | USD 3640.0 Billion |

| CAGR (2024-2032) | 40.2 % |

Note – Market size depicts the revenue generated over the financial year

The 5G market is expected to grow at a rapid pace. By 2032, it is expected to grow to $364.0 billion. This is a CAGR of 40.2% over the forecast period. This is due to the ever-increasing demand for high-speed connections and the proliferation of smart devices, which are becoming more and more essential to both the industrial and the domestic applications. The change from 4G to 5G is not just an increase in speed, but a revolution that makes it possible to develop new products such as the Internet of Things, self-driving vehicles, and smart cities. There are several key factors driving this growth, including the development of network technology, the expansion of 5G networks by telecommunications operators, and the growing use of cloud services. Companies such as Ericsson, Huawei, and Qualcomm are investing heavily in the research and development of 5G technology. The strategic alliances between operators and technology companies and the heavy investment in 5G network construction will also play an important role in the expansion of the market. The development of new applications and services is expected to create new revenue streams and enhance the user experience, which will help the market grow at an unprecedented rate.

Regional Market Size

Regional Deep Dive

The 5G market is growing rapidly in all regions. It is mainly driven by the rising demand for fast communication, the development of the Internet of Things and the proliferation of smart devices. Each region has its own characteristics, mainly influenced by regulations, technological conditions and economic development. North America is leading the 5G industry, with its well-developed telecommunications industry and major players. The Asia-Pacific region is developing rapidly, focusing on innovation and smart cities. Europe, with its regulatory challenges, is also making progress in the 5G industry, especially in urban areas. The Middle East and Africa are gradually developing, and Latin America is also beginning to adopt 5G, but at a slower speed due to its economic situation.

Europe

- The European Union has launched the '5G Action Plan' to ensure that all urban areas and major roads in Europe are covered by 5G by 2025, promoting collaboration among member states.

- Countries like Germany and the UK are investing heavily in 5G research and development, with companies like Deutsche Telekom and BT leading the charge in infrastructure deployment.

Asia Pacific

- China is at the forefront of 5G deployment, with companies like Huawei and ZTE playing crucial roles in building the necessary infrastructure, supported by government policies that prioritize technological advancement.

- South Korea has achieved significant milestones in 5G adoption, with SK Telecom and KT Corporation launching commercial services that cater to a wide range of industries, including healthcare and entertainment.

Latin America

- Brazil is emerging as a key player in the 5G market, with the government planning to auction 5G spectrum in 2024, which is expected to attract significant investment from telecom operators.

- Countries like Chile and Argentina are exploring pilot projects for 5G technology, focusing on urban connectivity and smart agriculture, although widespread adoption is still in its infancy.

North America

- The Federal Communications Commission (FCC) has been actively auctioning off spectrum for 5G, which has accelerated the deployment of 5G networks by major carriers like Verizon and AT&T.

- Innovations in edge computing and network slicing are being pioneered by companies such as T-Mobile, enhancing the capabilities of 5G networks to support diverse applications from gaming to autonomous vehicles.

Middle East And Africa

- The UAE has made significant investments in 5G technology, with Etisalat and du leading the deployment efforts, supported by government initiatives aimed at enhancing digital infrastructure.

- Countries like South Africa are beginning to roll out 5G services, with regulatory bodies working to allocate spectrum and encourage private sector investment in telecommunications.

Did You Know?

“As of 2023, over 70 countries have launched commercial 5G services, with Asia-Pacific leading the way in terms of the number of 5G subscriptions.” — GSMA Intelligence

Segmental Market Size

The 5G technology market is growing at a fast pace, driven by increasing demand for high-speed connection and low-latency applications. This is in line with the growing IoT market and the demand for enhanced mobile broadband services. In addition, the digital economy and the development of digital networks have sparked the demand for 5G equipment. At present, the 5G market has entered the commercialization stage, and industry leaders such as Verizon and Huawei have already built extensive 5G networks in major cities. The use of 5G has been widely recognized in various industries, such as smart cities, intelligent transport systems, and telemedicine, demonstrating the versatility of the technology. Meanwhile, macro trends such as digital transformation are driving the growth of the market, and companies are trying to take advantage of 5G to improve efficiency. The development of edge computing and network slicing will also help operators to provide tailored services and better experiences for users.

Future Outlook

The fifth-generation network will grow at an annual rate of 40.2% between 2024 and 2032. The market value of the fifth-generation network will rise from $243.1 billion to $364.0 billion, with a CAGR of 40.2%. This unprecedented growth is mainly driven by the rising demand for fast Internet access, the proliferation of smart devices, and the expansion of smart cities. By 2032, the penetration rate of 5G will reach 71%, and the user experience will be significantly improved in the field of health care, automobiles, and entertainment. In addition, the independent development of 5G and the integration of edge computing will further promote the growth of the industry. The role of government policies and the construction of telecommunications facilities is also very important. The emergence of new trends, such as the development of augmented reality, virtual reality, and self-driving vehicles, will bring new business opportunities and reshape the consumption pattern. The fifth-generation industry chain is maturing, and the industry needs to be agile to seize the opportunities and effectively control the development of the industry chain.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 121.2 Billion |

| Market Size Value In 2023 | USD 171.7 billion |

| Growth Rate | 40.2% (2022-2030) |

5G Technology Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.