Advancements in Satellite Technology

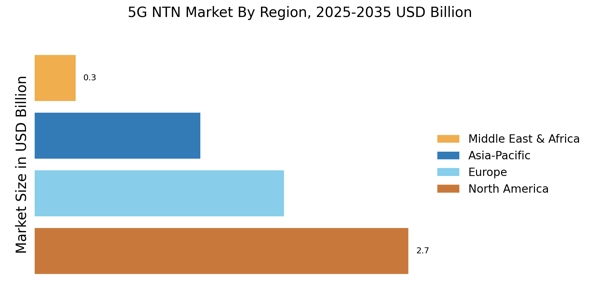

Advancements in satellite technology are significantly influencing the 5G NTN Market. Innovations in satellite design, launch capabilities, and operational efficiency are enabling the deployment of more effective and cost-efficient satellite networks. These advancements facilitate the integration of satellite communication with terrestrial networks, enhancing coverage and connectivity in remote and underserved areas. The emergence of low Earth orbit (LEO) satellite constellations is particularly noteworthy, as they promise to deliver high-speed internet access globally. As the satellite industry continues to evolve, the 5G NTN Market stands to benefit from improved service offerings and expanded market reach, potentially transforming how connectivity is delivered across diverse regions.

Regulatory Support for 5G Deployment

Regulatory support for 5G deployment is emerging as a crucial driver of the 5G NTN Market. Governments and regulatory bodies are increasingly recognizing the importance of 5G technology in fostering economic growth and innovation. As a result, many countries are implementing policies and frameworks to facilitate the rapid deployment of 5G infrastructure. This regulatory environment encourages investment and collaboration among stakeholders, including telecommunications companies, satellite operators, and technology providers. The establishment of favorable regulations can expedite the rollout of 5G NTN Market solutions, ultimately enhancing connectivity and service delivery. As regulatory support continues to evolve, the 5G NTN Market is likely to experience accelerated growth and development.

Expansion of Smart Cities Initiatives

The expansion of smart cities initiatives is driving the 5G NTN Market as urban areas increasingly adopt advanced technologies to enhance infrastructure and services. Smart cities rely on seamless connectivity to integrate various systems, including transportation, energy, and public safety. The implementation of 5G NTN Market solutions is crucial for enabling real-time data exchange and communication among these systems. As cities strive to improve efficiency and sustainability, the demand for 5G NTN Market technologies is expected to rise. Reports suggest that investments in smart city projects could exceed 2 trillion dollars by 2030, highlighting the potential for growth within the 5G NTN Market as municipalities seek to leverage cutting-edge communication technologies.

Growing Demand for High-Speed Connectivity

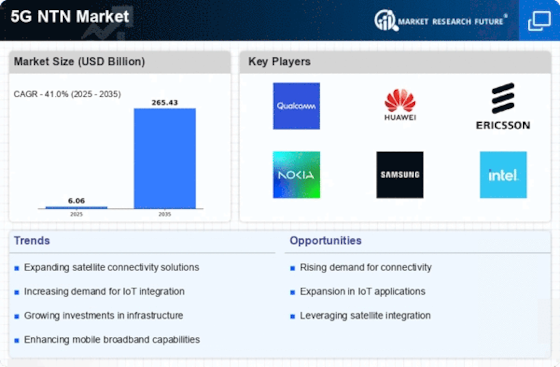

The increasing demand for high-speed connectivity is a primary driver of the 5G NTN Market. As businesses and consumers alike seek faster and more reliable internet access, the need for advanced communication technologies becomes evident. The proliferation of IoT devices and smart technologies further amplifies this demand, as these applications require robust connectivity solutions. According to recent data, the number of connected devices is projected to reach over 30 billion by 2030, necessitating the deployment of 5G NTN Market solutions to support this growth. This trend indicates a significant opportunity for stakeholders in the 5G NTN Market to innovate and expand their offerings, catering to the evolving needs of users across various sectors.

Increased Focus on Remote Connectivity Solutions

The increased focus on remote connectivity solutions is a significant driver of the 5G NTN Market. As organizations and individuals seek reliable communication options in remote and rural areas, the demand for 5G NTN Market technologies is likely to grow. This trend is particularly relevant in sectors such as agriculture, mining, and emergency services, where connectivity is essential for operational efficiency and safety. The ability of 5G NTN Market solutions to provide high-speed internet access in challenging environments positions them as a vital resource for enhancing productivity and connectivity. Market analyses indicate that the demand for remote connectivity solutions could lead to a substantial increase in investments in the 5G NTN Market, as stakeholders aim to address these emerging needs.