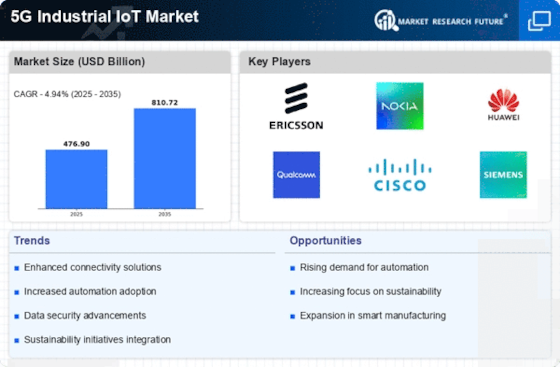

Market Share

5G Industrial IoT Market Share Analysis

Market percentage positioning techniques in the 5G Industrial Internet of Things (IIoT) market are fashioned by way of a dynamic interplay of aspects, reflecting the aggressive platform and the evolving desires of industries. One high strategy entails early marketplace access, wherein the group's purpose is to establish a strong foothold with the aid of being some of the first to provide comprehensive 5G IIoT solutions. This early mover gain permits agencies to build brand reputation, increase strategic partnerships, and seize a good-sized percentage of the rising marketplace. Vertical integration is a method that a few businesses undertake to reinforce their marketplace positioning.

By controlling a couple of tiers of the value chain, from hardware manufacturing to software program development and provider provision, groups can optimize efficiency, ensure product compatibility, and provide cease-to-cease answers. This technique can enhance competitiveness and marketplace share by providing a continuing and comprehensive enjoyment for commercial clients. Customer-centric techniques are crucial to a successful market share positioning inside the 5G IIoT market. Understanding the unique desires of industrial clients and presenting customized answers may be a high differentiator. This entails non-stop engagement, feedback series, and the version of services and products to align with evolving customer requirements. By prioritizing consumer pride and constructing long-term relationships, companies can steady a loyal client base, driving a sustained marketplace proportion boom.

Flexibility and adaptability are crucial inside the swiftly evolving platform of 5G IIoT. Companies that demonstrate the potential to adapt to technological advancements, regulatory changes, and emerging market tendencies function themselves favorably. This agility allows them to capitalize on new opportunities unexpectedly, address evolving patron needs, and stay ahead of the opposition, thereby securing and increasing their market proportion. In the give-up, marketplace percentage positioning techniques in the 5G Industrial IoT marketplace are various and dynamic, reflecting the aggressive nature of the industry and the evolving needs of industrial clients. Whether via early market entry, differentiation, collaborations, vertical integration, marketplace penetration, purchaser-centric procedures, flexibility, or international enlargement, agencies navigate a complicated platform to set up a robust market presence. In this era of digital transformation, the strategic choices made via agencies will shape their role inside the 5G IIoT marketplace and influence the trajectory of connected and intelligent business ecosystems.

Leave a Comment